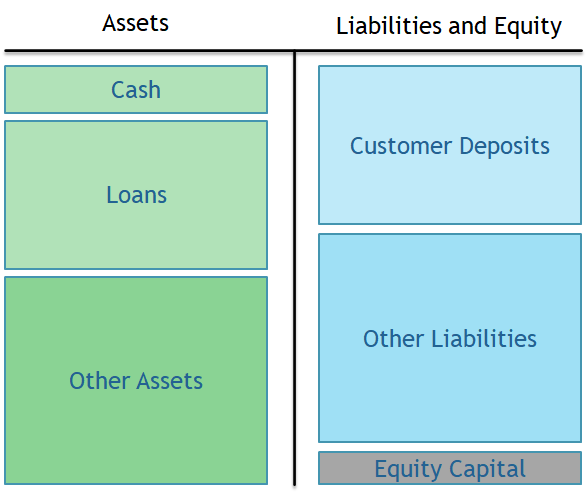

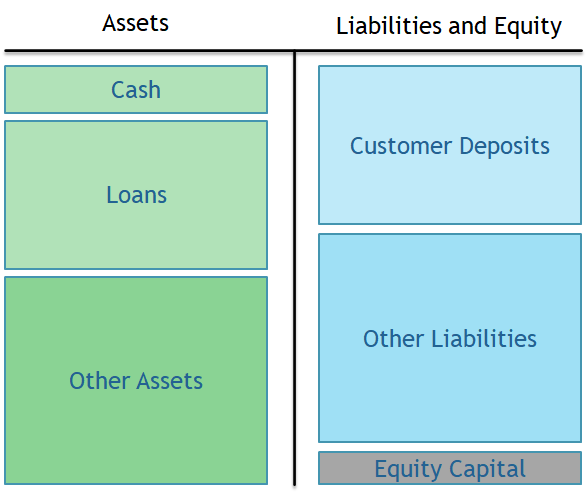

Use MobLab’s Bank Run game to illustrate how mere doubts about a bank’s liquidity may lead to a self-fulfilling prophecy that comes to fruition in its failure. Our bank’s customers have the right to withdraw their deposits anytime, and the bank uses these deposits as a basis for loans which can not be converted into cash immediately. A brief look at a simplified balance sheet of a bank reveals that the cash of a bank is not sufficient if a large number of customers want to withdraw their deposits at the same time.

This can lead to an interesting behavioral phenomenon which is not about the actual economic state of the bank but about the belief concerning that state of other customers. As long as a substantial minority of a bank’s customers believe that the bank is in distress and try to withdraw their deposits, it is rational for you to run to your local branch in order to avoid being the last person in the queue and potentially not getting any money. Ironically, a customer’s mere concern about other customers’ concerns causes them to trigger the bank failure they so fear.

Lowering the bank’s liquidity rate: The liquidity rate determines the number of withdrawals the bank is able to honor before becoming insolvent. Increasing the group size: By default students are placed in groups of 6. According to our observations, a larger group size amplifies the bank run dynamic and increases the likelihood of a bank run to occur. Introduce forced withdrawals: With this rule a certain number of students will be forced to withdraw their money prematurely due to e.g. a medical bill or some other external factor.

On the other hand, a small group size, lowering the number of rounds, increasing the return on investment, or enabling chat, will increase the chances of the bank to survive.

The results below demonstrate how a deposit insurance is able to break the spell of the self-fulfilling prophecy that leads to a bank run. In countries that implemented a deposit insurance bank runs have indeed become very rare.

Check out MobLab’s economics games on Moral Hazard to further expose this phenomenon or get in touch with our team to see more games on this topic. Click here to schedule a one-on-one demo meeting.

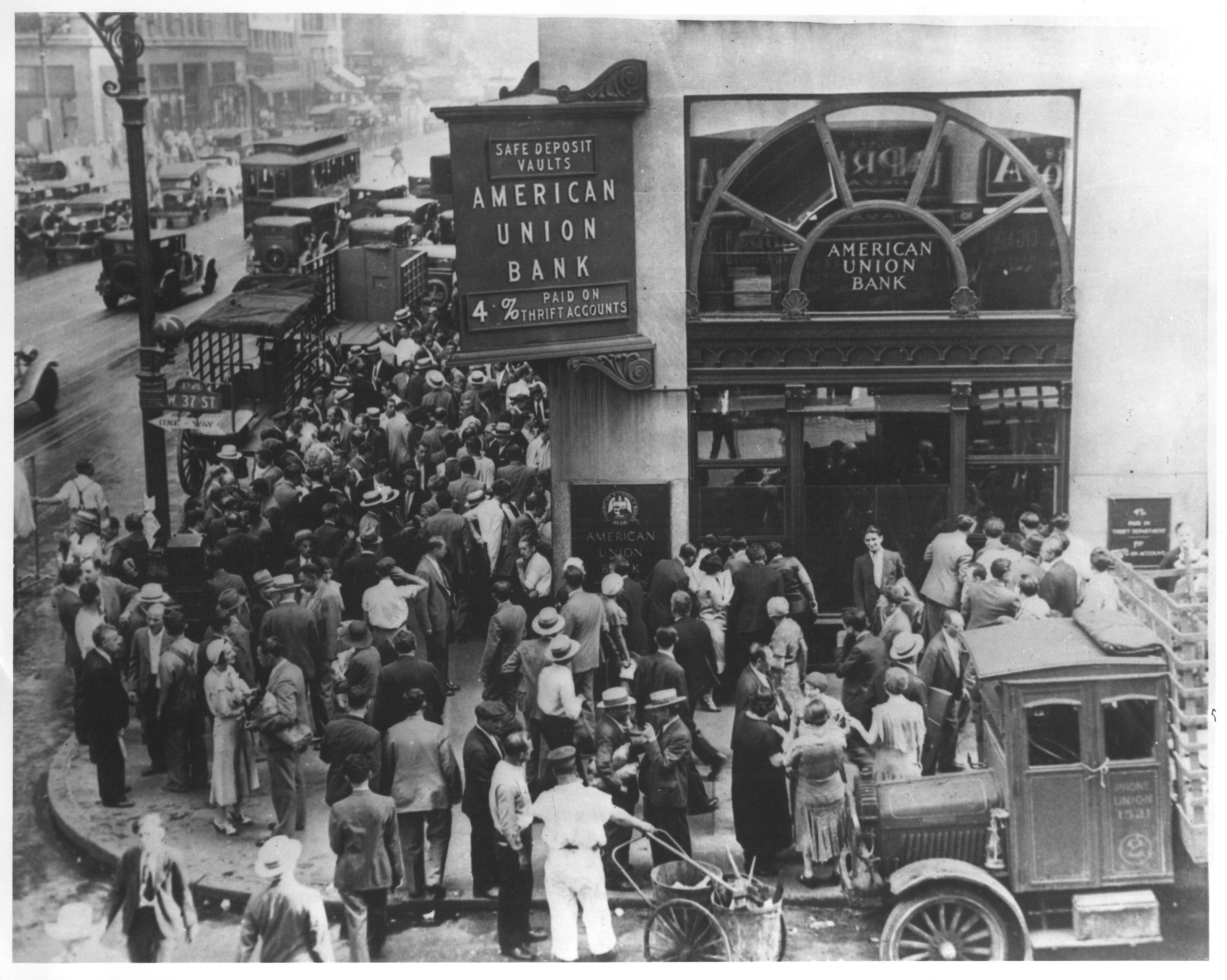

This can lead to an interesting behavioral phenomenon which is not about the actual economic state of the bank but about the belief concerning that state of other customers. As long as a substantial minority of a bank’s customers believe that the bank is in distress and try to withdraw their deposits, it is rational for you to run to your local branch in order to avoid being the last person in the queue and potentially not getting any money. Ironically, a customer’s mere concern about other customers’ concerns causes them to trigger the bank failure they so fear.

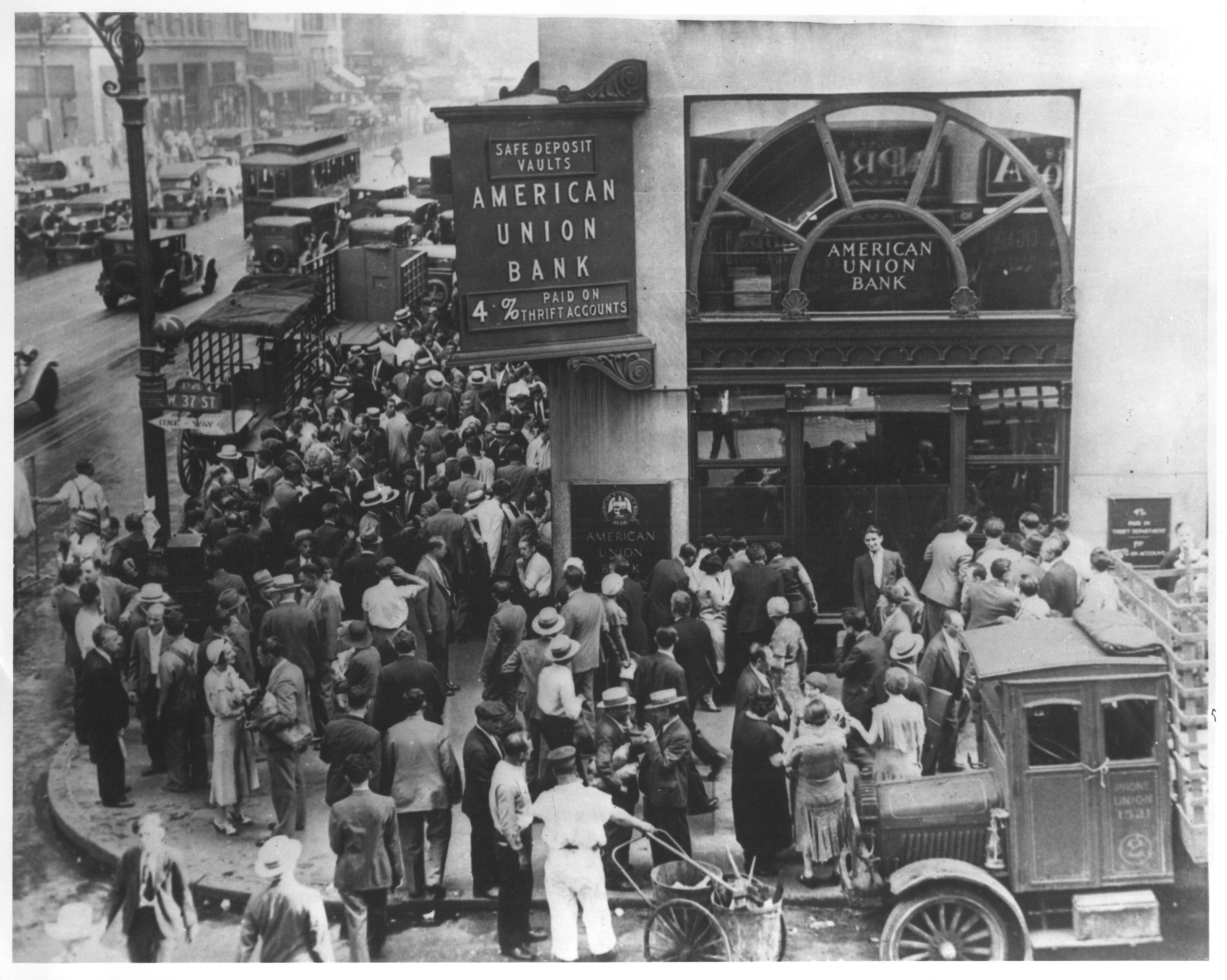

Bank Run on the American Union Bank, New York City

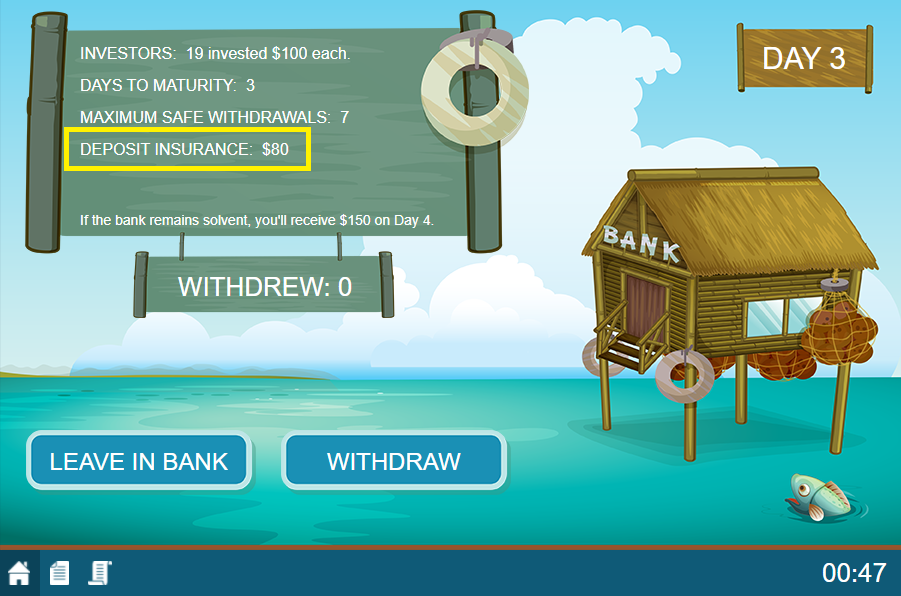

MobLab’s Bank Run Game

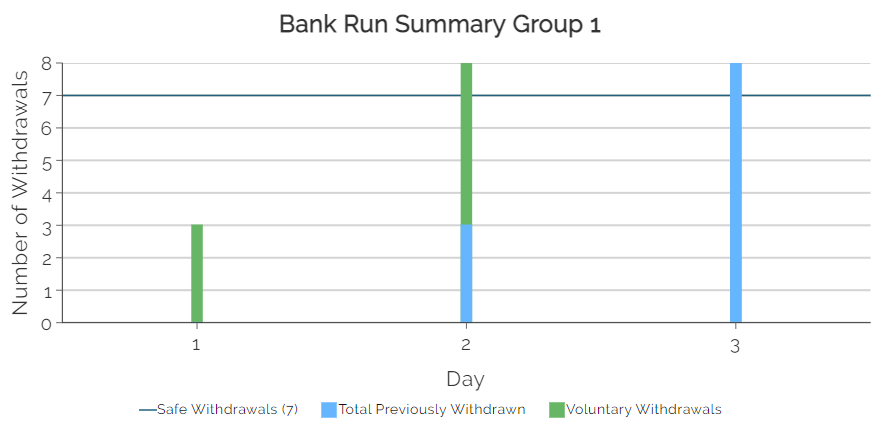

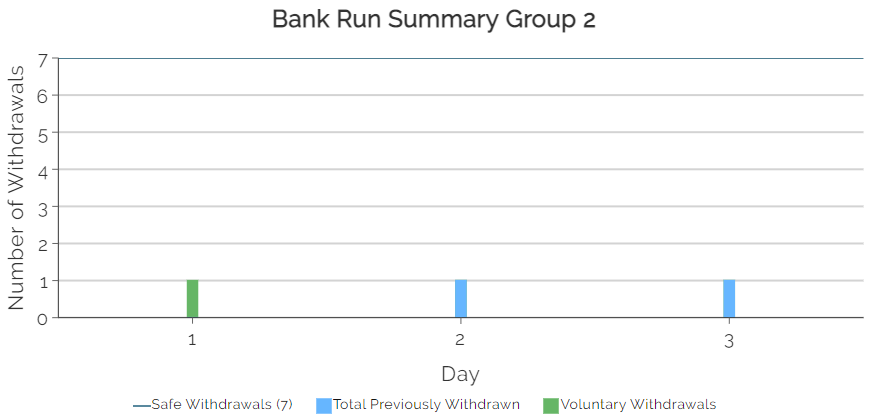

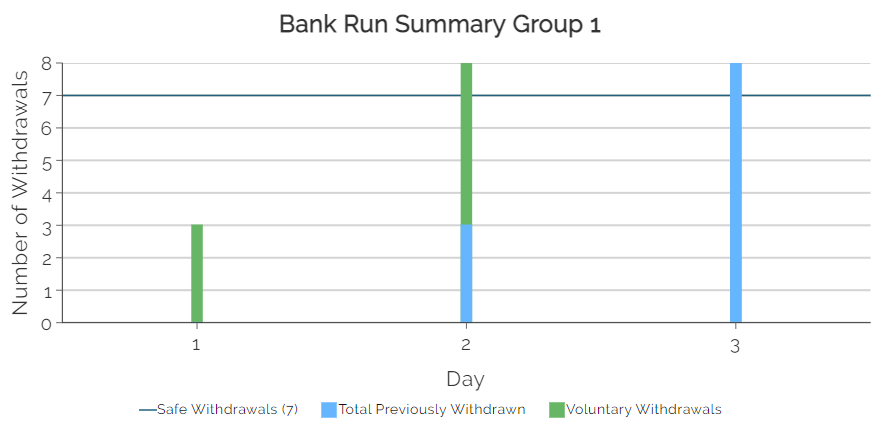

With MobLab’s Bank Run game your students experience this dynamic in a simple classroom experiment. Every student deposits $100 at a bank. The bank uses this money to make a loan which will be repaid after a certain number of days. On each day, all students individually and simultaneously choose whether to withdraw, and the total number of withdrawals is announced to all. The bank can honor a certain number of withdrawals, but if too many withdraw, the bank fails and those who have not withdrawn lose their investment. If the bank does not fail, then all who have not withdrawn receive their deposit plus a return on their investment. Hence, there exists a non-withdraw equilibrium in which all students leave their money at the bank and benefit from the interest rate revenue. However, as the following results from a class in Switzerland with nineteen students demonstrate, little is needed to trigger the above described dynamic. The three students who chose to withdraw their money on Day 1 triggered five additional students to withdraw on Day 2. This already exceeded what the bank was able to honor and caused it to fail - proving that not even Swiss banks are safe from bank runs.

The 3 students who withdrew their deposit on day one triggered 5 more students to withdraw on day two. Thus, causing the bank to fail.

Play the Bank Run Game with Different Rules

The game configurations offer advanced options that will increase the likelihood of a Bank Run:On the other hand, a small group size, lowering the number of rounds, increasing the return on investment, or enabling chat, will increase the chances of the bank to survive.

Increase the likelihood of a bank run by introducing forced withdrawals.

Deposit Insurance

In the aftermath of some of the worst bank runs during the Great depression of the 1930s many governments implemented deposit insurances to protect bank depositors. The Federal Deposit Insurance Corporation (FDIC) in the US for instance insures a depositors' first $250,000.

A deposit insurance is an economic solution to minimize the risk of a bank run.

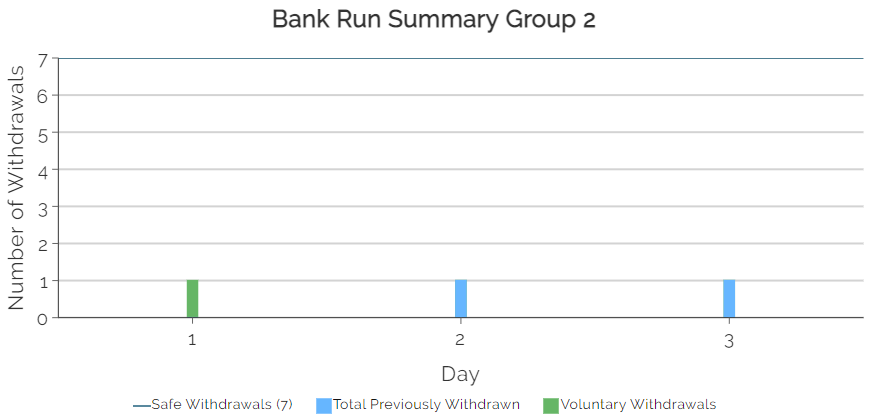

The results below demonstrate how a deposit insurance is able to break the spell of the self-fulfilling prophecy that leads to a bank run. In countries that implemented a deposit insurance bank runs have indeed become very rare.

With the deposit insurance, only one student chose to withdraw their money on day one.

However, economists pointed out that the presence of the insurance may lead to another undesired behavioral phenomenon: Customers may no longer seek to deposit their money at the bank they deem to be the safest rather they will look for the one that offers the highest return on investment and thus likely engages in the riskiest business models. Check out MobLab’s economics games on Moral Hazard to further expose this phenomenon or get in touch with our team to see more games on this topic. Click here to schedule a one-on-one demo meeting.