At the time of writing this article, financial news has been full of posts regarding liquidity and the failure of cryptocurrency companies. In particular, the collapse of crypto exchange FTX in November 2022 began when FTX customers demanded $6 billion of withdrawals and the exchange did not have enough funds to cover the withdrawal requests. As a result, FTX’s native token, FTT, fell spectacularly in value. It was this token that had previously artificially propped up FTX and its sister company, Alameda Research. Bankruptcies of both companies soon followed, and at the time of this writing, criminal investigations of both companies are ongoing.

The collapse of FTX is a good real-world lesson in market liquidity and students can experience this phenomena (safely) in the classroom with MobLab’s Bank Run game.

Students will take on the role of individual depositors who wish to deposit their money ($100) into the local bank. Below is an explanation of the game’s default parameters:

Students are placed into group sizes of six students each. The bank returns $150 on each students’ $100 Deposit that is not withdrawn after three days, resulting in a potential Rate of Return of 50%. The Days to Maturity of student deposits is 3 days, and the Liquidity Rate is 60%. Keeping these default parameters but setting Periods greater than 1 (i.e., groups remain fixed over multiple periods) will generally result in some groups converging to day-one withdrawals and others finding the equilibrium where nobody withdraws. If a certain number of students decide to withdraw then a run on the bank will result, just like what FTX experienced.

The risk reward dynamics of the bank run game are analogous to how individuals in the real world were staking their cryptocurrencies on exchanges (like FTX and others) to generate high yield returns… as long as the those exchanges remained solvent.

The bank can honor a certain number of withdrawals, but if too many depositors withdraw, the bank fails and those who have not withdrawn lose their investment. This is the definition of a bank run, or rather, a run on liquidity which leads to insolvency and oftentimes eventual bankruptcy of a company.

In the case of FTX, early withdrawals on the exchange were triggered by crypto news site CoinDesk, reporting that Alameda Research (FTX’s sister company) had a $5 billion position in FTT, the native token of FTX. Alameda’s investment foundation was also denominated in FTT on the assets portion of its balance sheet and not fiat currency nor other crypto currencies. As a result, the crypto industry and users of FTX became very concerned about their holdings on the exchange and began to request withdrawal of their funds. Much like fractional banking, a bank (liquidity) run may become self-fulfilling and the same general concept applies to a crypto exchange. Early withdrawals from FTX lead to fear and hastening of the firm’s failure. The underlying complex reasons behind liquidity dynamics, even in the crypto space, can be simply taught to students with MobLab’s Bank Run game.

Want to see more interactive simulations of financial markets on our platform in action, like our Interest Rates & Inflation game? Get in touch for a personalized tour of the MobLab economics game platform.

The collapse of FTX is a good real-world lesson in market liquidity and students can experience this phenomena (safely) in the classroom with MobLab’s Bank Run game.

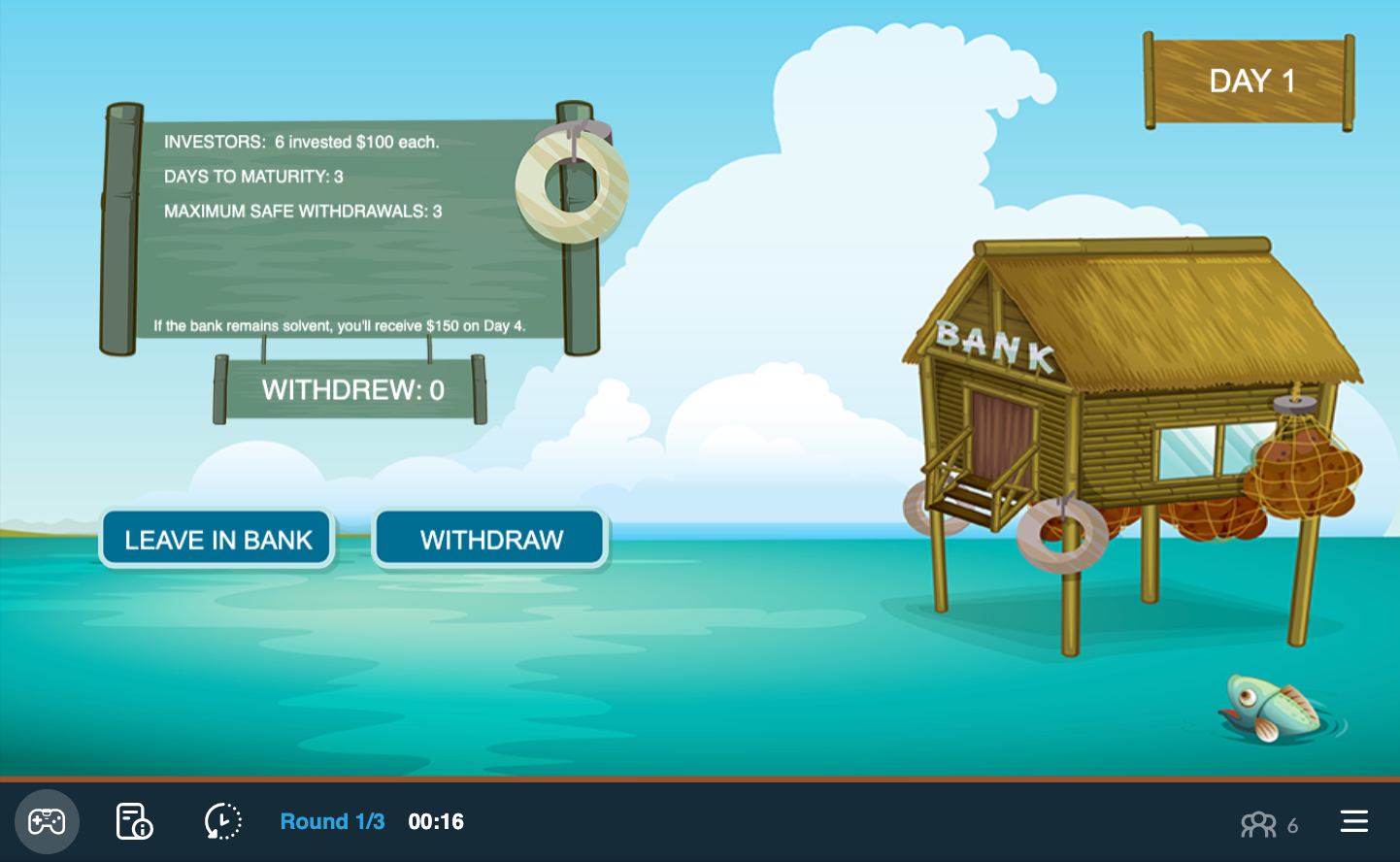

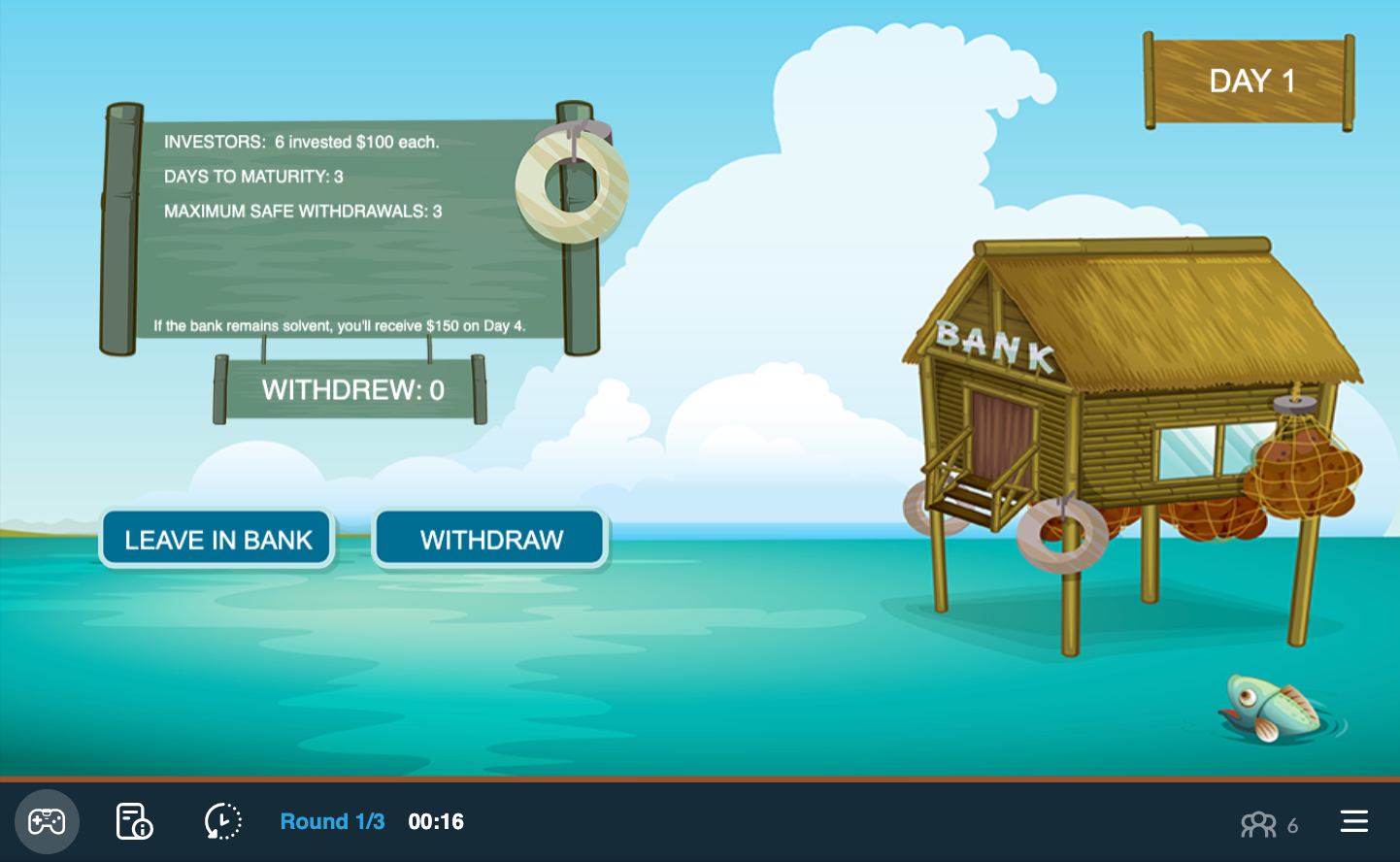

Day 1 of the bank being above water for now…

Students will take on the role of individual depositors who wish to deposit their money ($100) into the local bank. Below is an explanation of the game’s default parameters:

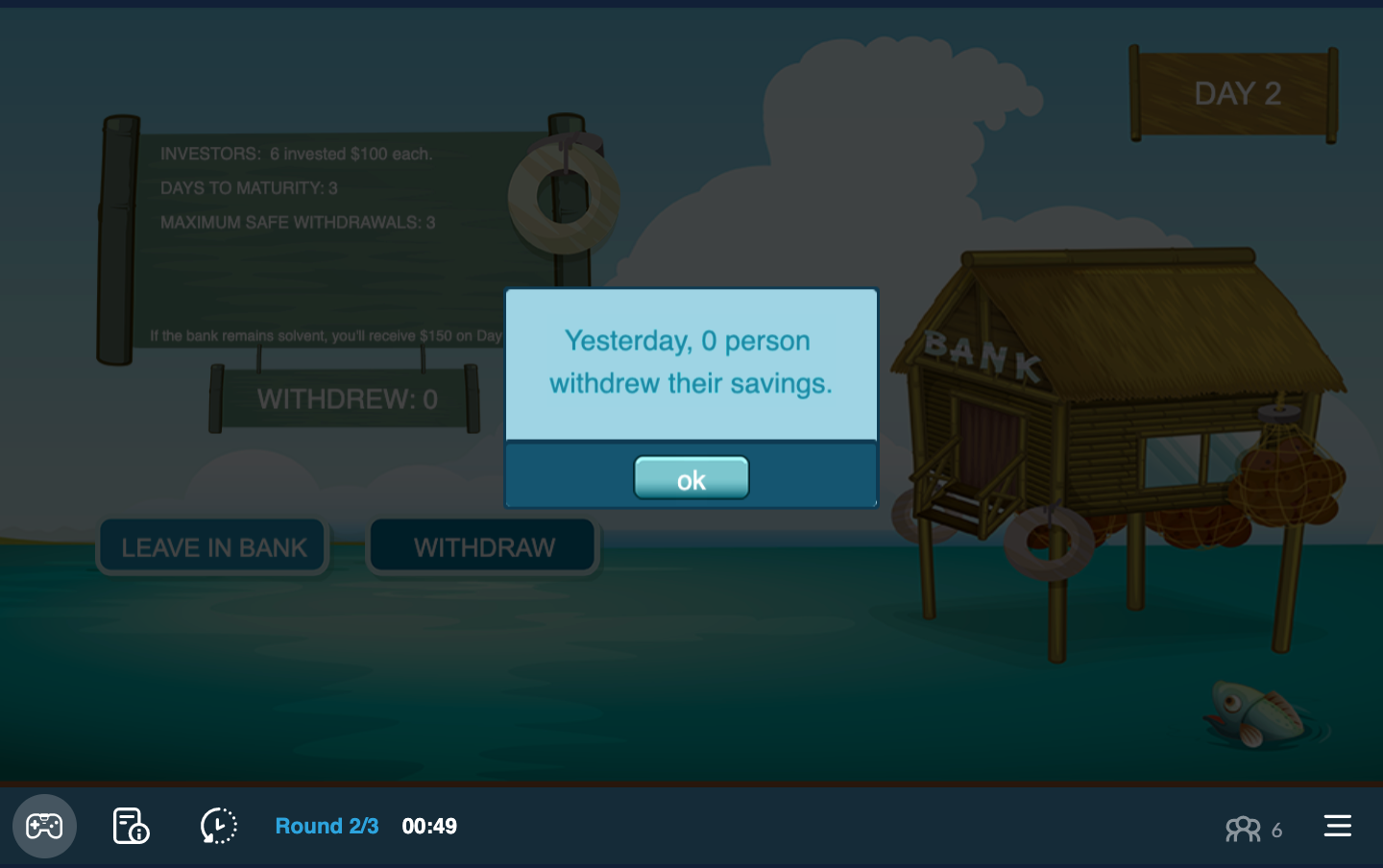

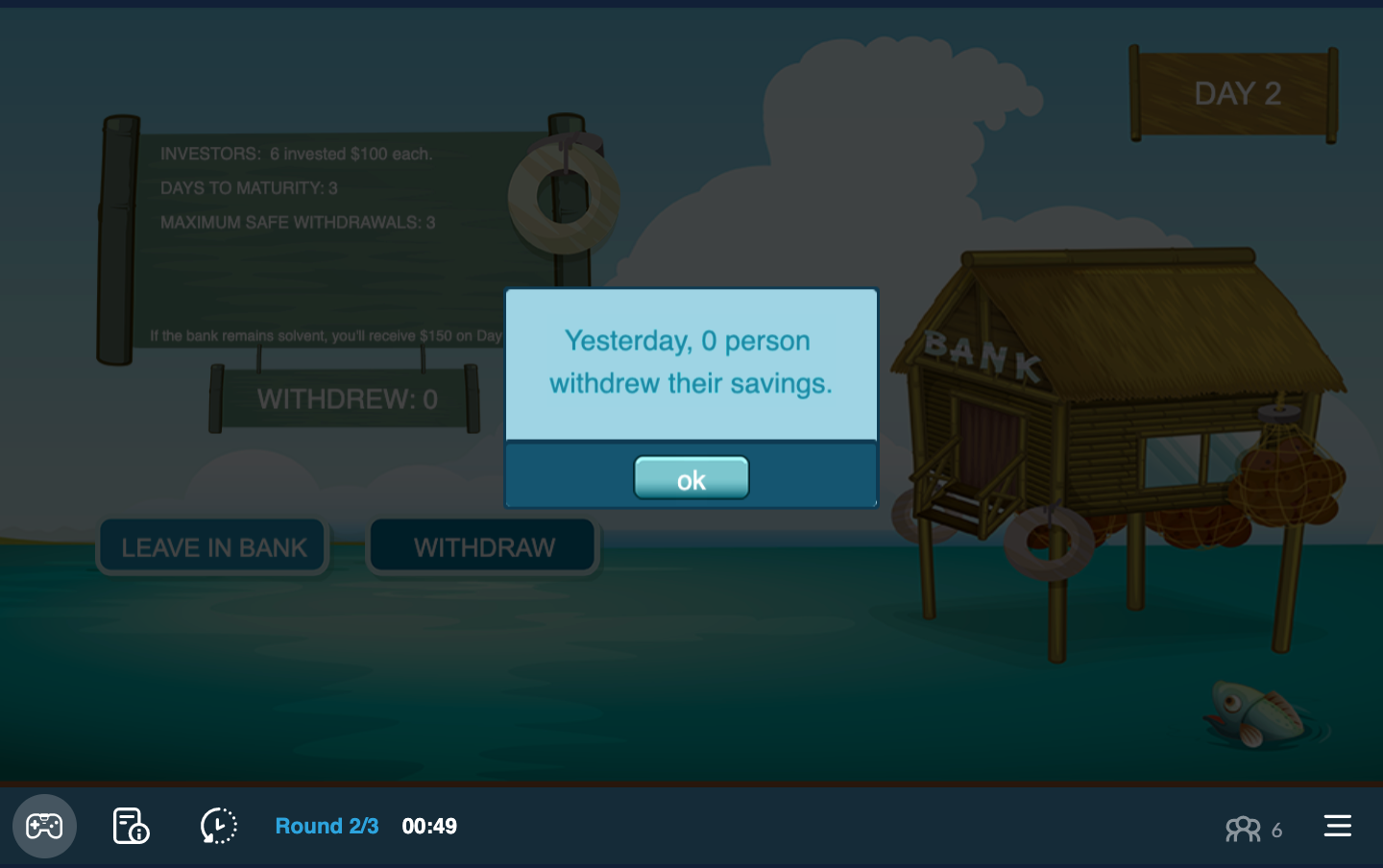

Students are placed into group sizes of six students each. The bank returns $150 on each students’ $100 Deposit that is not withdrawn after three days, resulting in a potential Rate of Return of 50%. The Days to Maturity of student deposits is 3 days, and the Liquidity Rate is 60%. Keeping these default parameters but setting Periods greater than 1 (i.e., groups remain fixed over multiple periods) will generally result in some groups converging to day-one withdrawals and others finding the equilibrium where nobody withdraws. If a certain number of students decide to withdraw then a run on the bank will result, just like what FTX experienced.

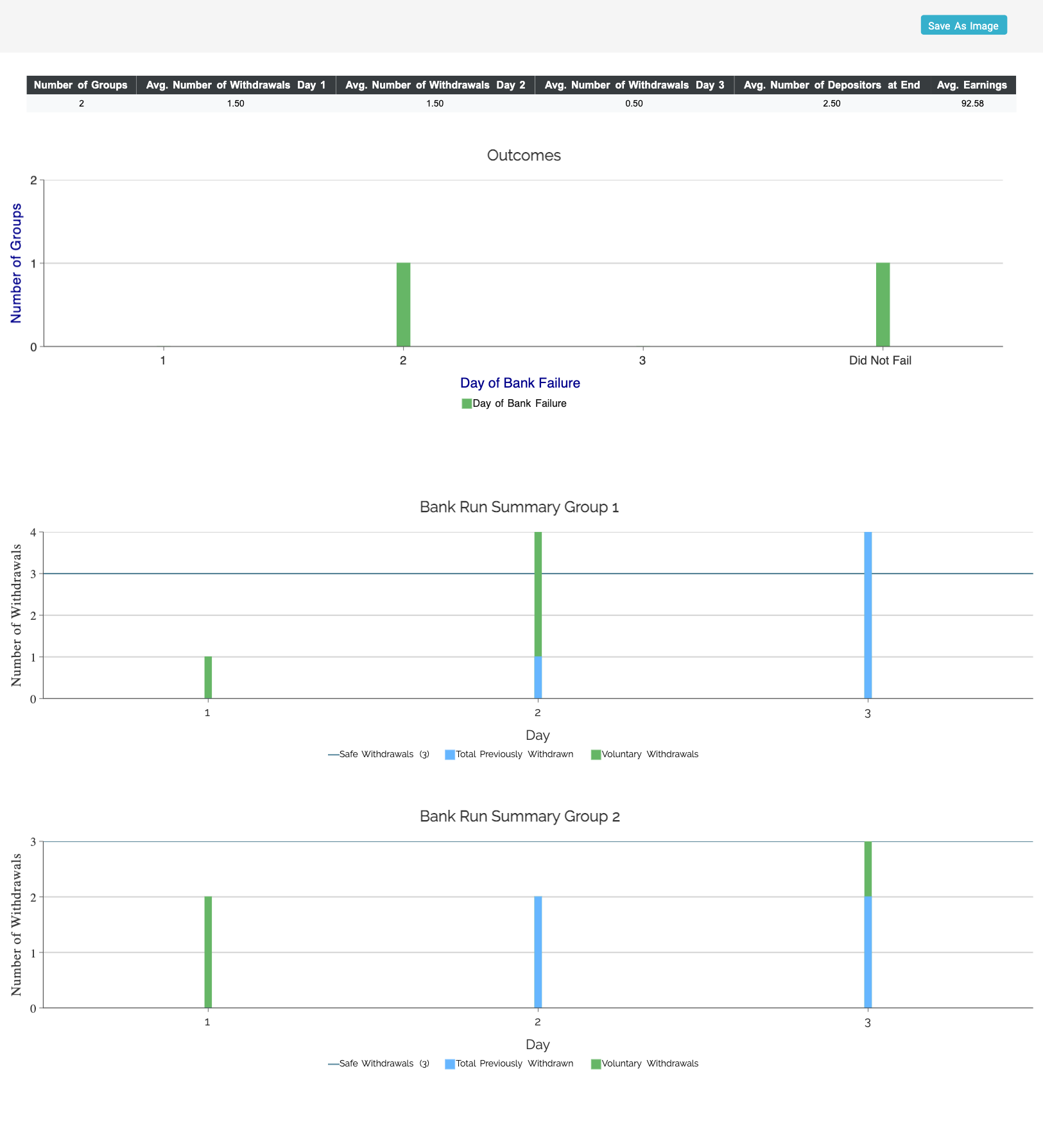

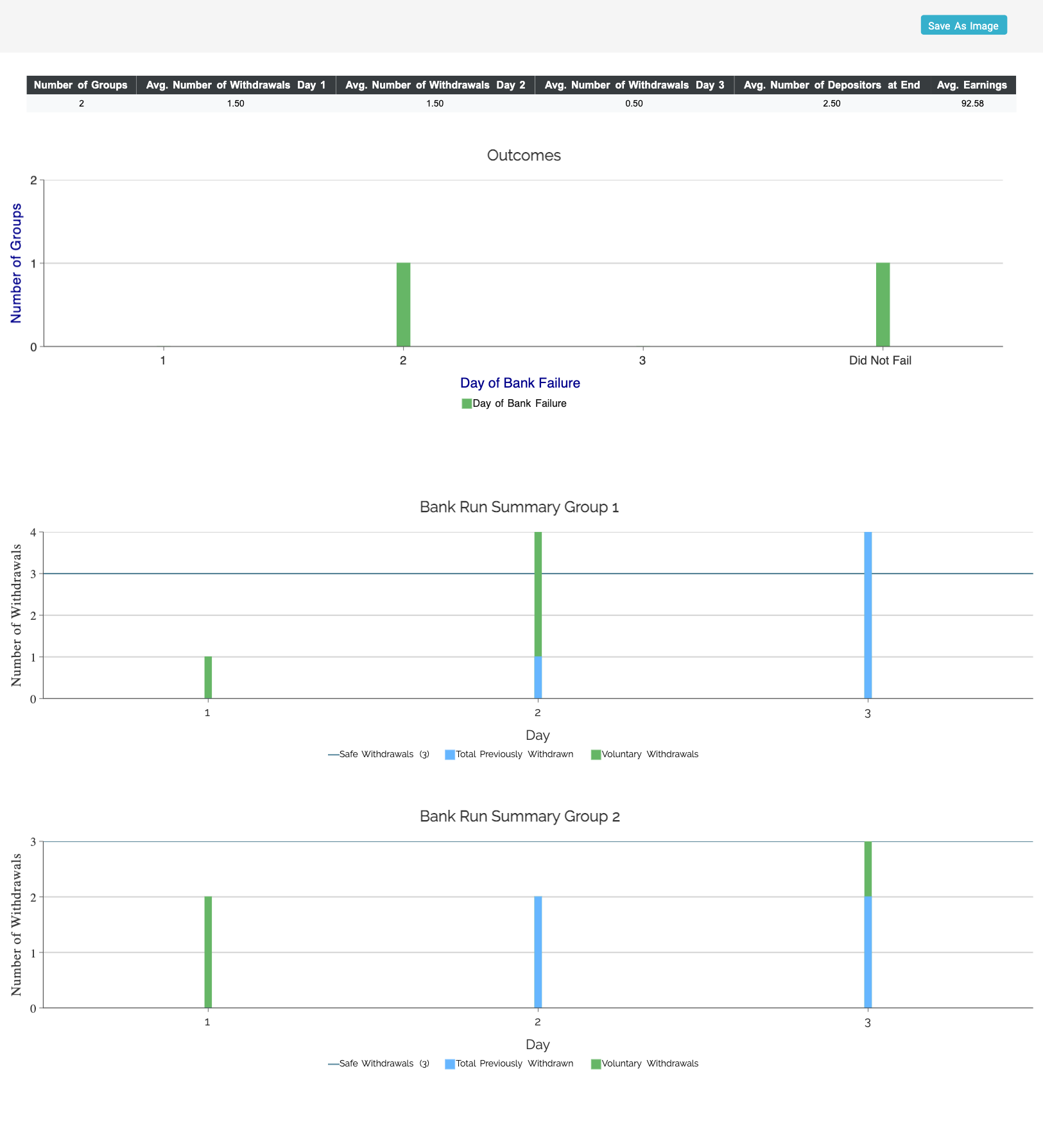

Game results indicating a bank run that occurred on Day 2. Note how one group out of the three groups was able to withdraw their funds successfully before the bank’s insolvency.

The risk reward dynamics of the bank run game are analogous to how individuals in the real world were staking their cryptocurrencies on exchanges (like FTX and others) to generate high yield returns… as long as the those exchanges remained solvent.

In this example, no players have withdrawn their funds yet. The bank is still above water (is liquid) as a result.

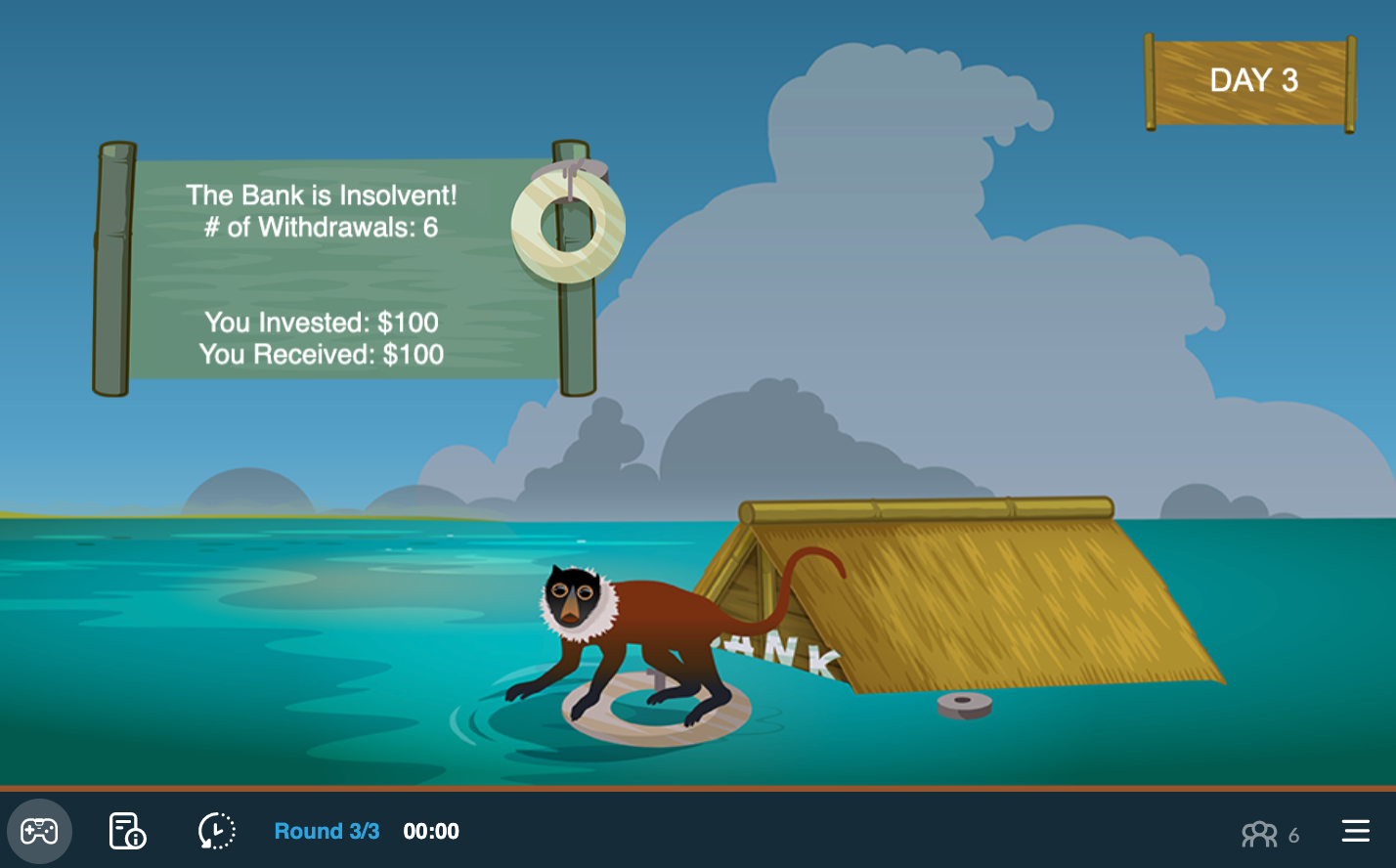

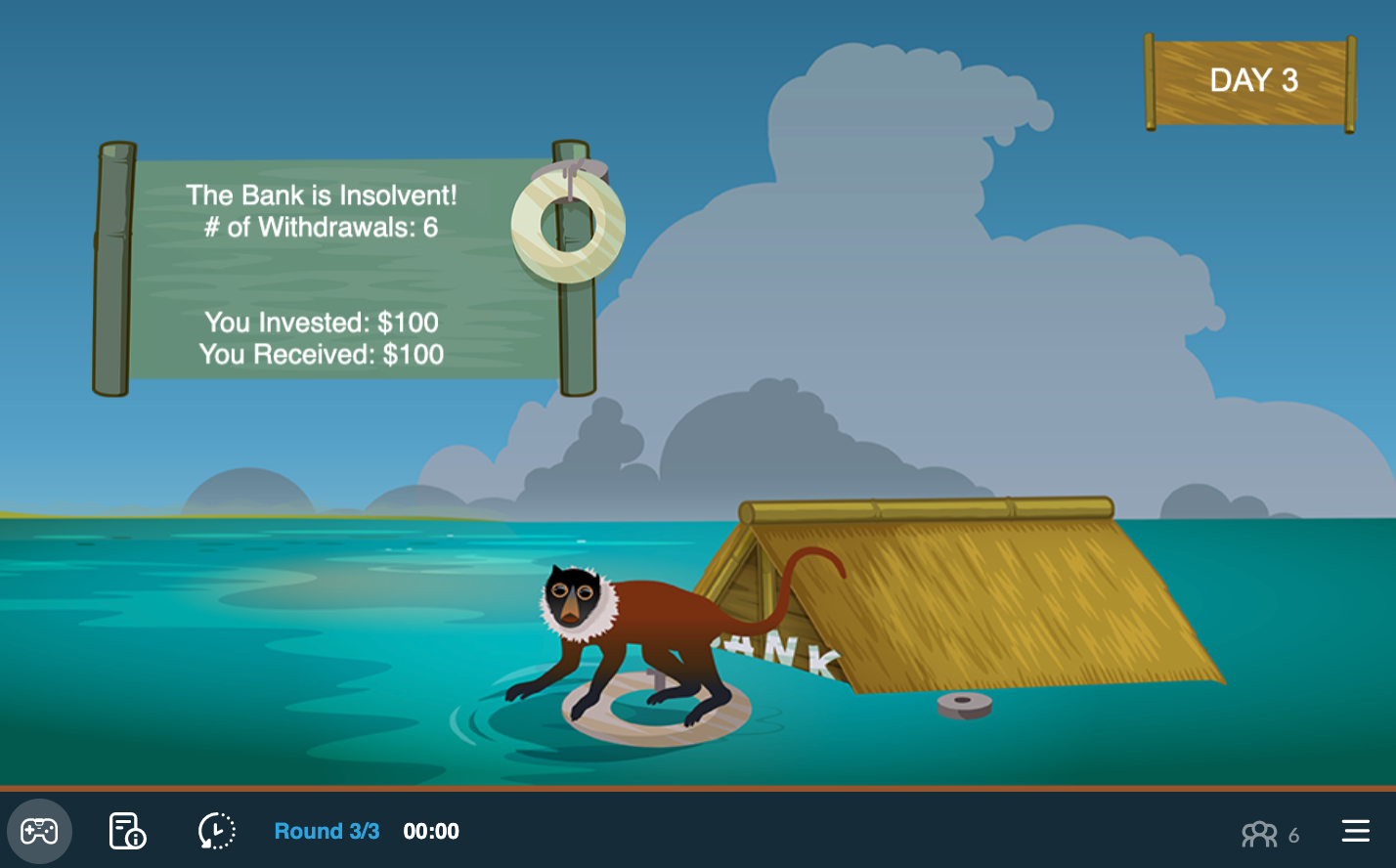

The bank can honor a certain number of withdrawals, but if too many depositors withdraw, the bank fails and those who have not withdrawn lose their investment. This is the definition of a bank run, or rather, a run on liquidity which leads to insolvency and oftentimes eventual bankruptcy of a company.

Oh no! The bank is now underwater due to being insolvent.

In the case of FTX, early withdrawals on the exchange were triggered by crypto news site CoinDesk, reporting that Alameda Research (FTX’s sister company) had a $5 billion position in FTT, the native token of FTX. Alameda’s investment foundation was also denominated in FTT on the assets portion of its balance sheet and not fiat currency nor other crypto currencies. As a result, the crypto industry and users of FTX became very concerned about their holdings on the exchange and began to request withdrawal of their funds. Much like fractional banking, a bank (liquidity) run may become self-fulfilling and the same general concept applies to a crypto exchange. Early withdrawals from FTX lead to fear and hastening of the firm’s failure. The underlying complex reasons behind liquidity dynamics, even in the crypto space, can be simply taught to students with MobLab’s Bank Run game.

Want to see more interactive simulations of financial markets on our platform in action, like our Interest Rates & Inflation game? Get in touch for a personalized tour of the MobLab economics game platform.