Are you a conformist or a contrarian? Wolf or sheep? Perhaps a bit of both depending on the situation?

Herding behavior and its associated information cascades happen in all sorts of situations: stock markets, food trends, and viral information (and misinformation) on social media are just some examples.

In the field of psychology, one notable example of conforming herding behavior is the Asch Conformity Experiments in the 1950’s. Groups of eight male college students were given a task of identifying the lengths of lines on cards. However, all the subjects were actors except one. The objective of the study was to gauge how the sole non-actor subject would react to the actor subjects’ behavior. The conclusion of the experiments was that most subjects dismissed their own private information to conform to the groups they were placed in. Approximately 75% of the experiment’s participants conformed with the rest of the group at least once. The results of these experiments are still debated to this day.

With MobLab’s Herding (Information Cascade) game, students can experience the phenomena of information cascades in the classroom.

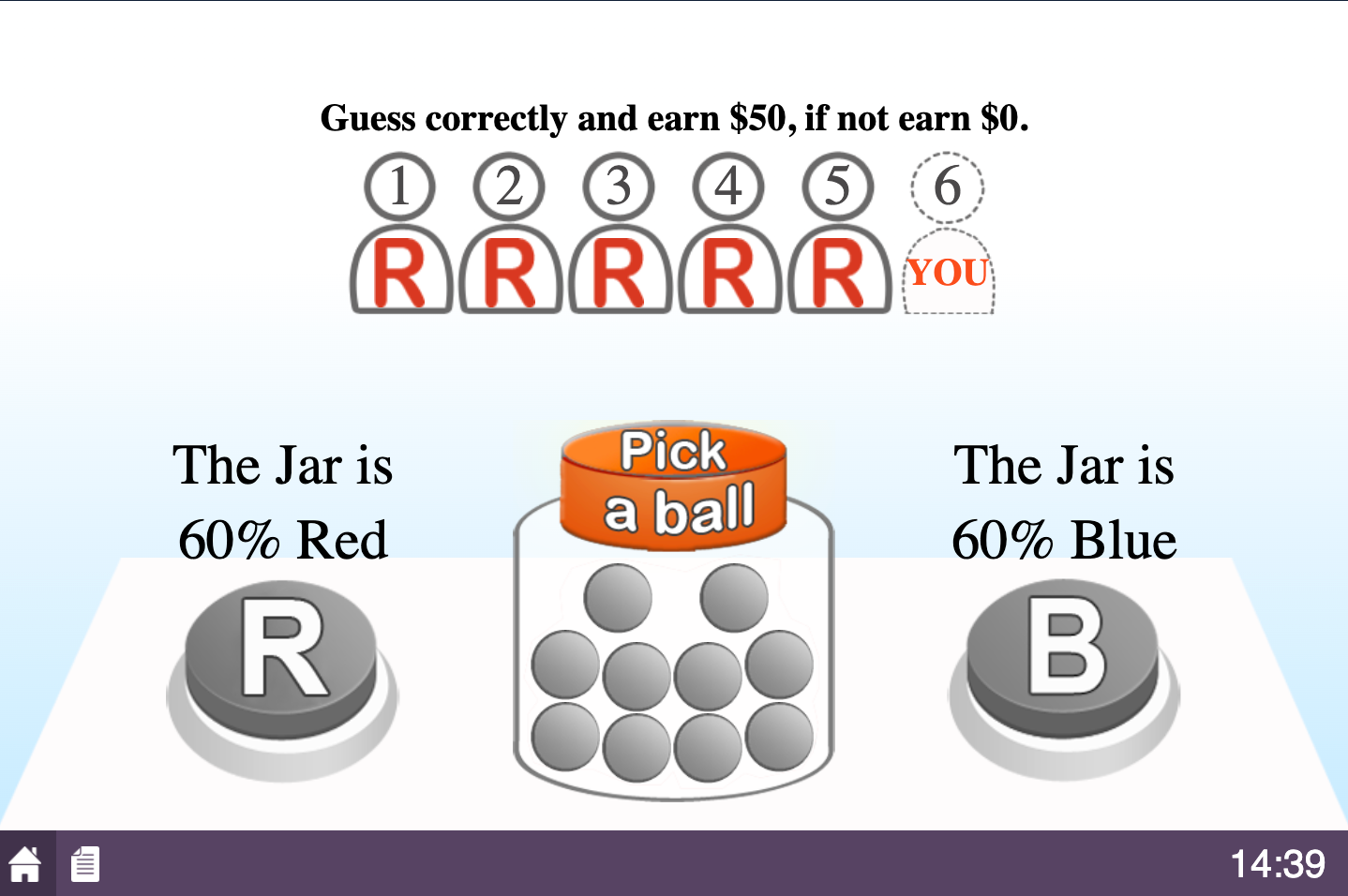

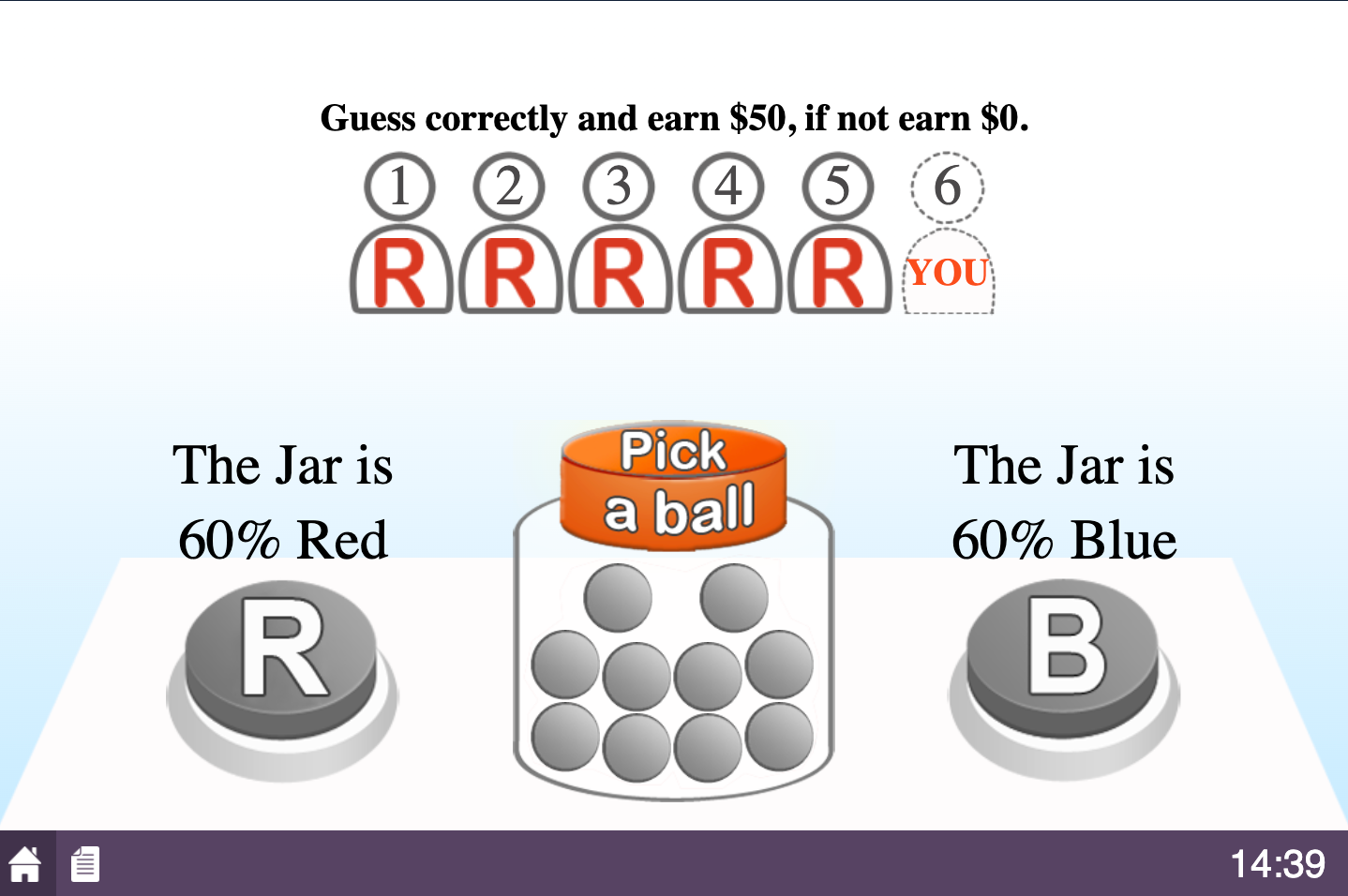

In the Herding game, students are placed into groups and draw at random either a blue or red ball from a jar. Players do not know how many blue or red balls are inside. They individually guess if the jar contains majority blue or red balls. Individual students in the group see the guesses of other players (but not what colored ball they selected at the random drawing). Will the students make their individual guesses based on the colored ball they selected (private information) or will they be influenced by the guess made by the player(s) before their turn (public information)?

In this play-through example, the final player (Player 6) has seen the guesses of players 1 through 5. Note how players 1 through 5 all guessed red most likely based on the previous players’ red guesses (public information). This phenomena is an information cascade, and in particular, an information cascade of red ball guesses. Player 6 now needs to pick a random ball from the jar.

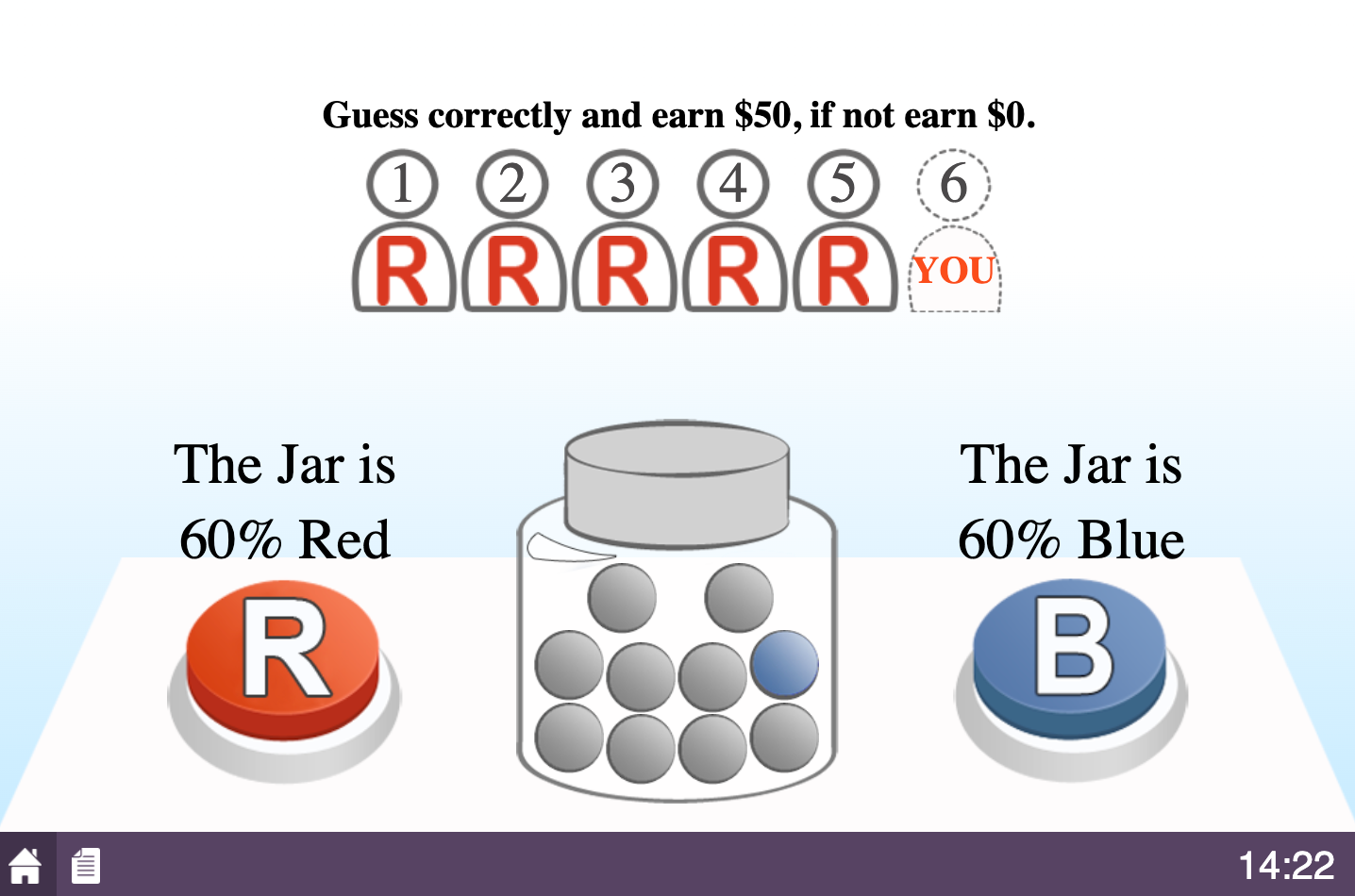

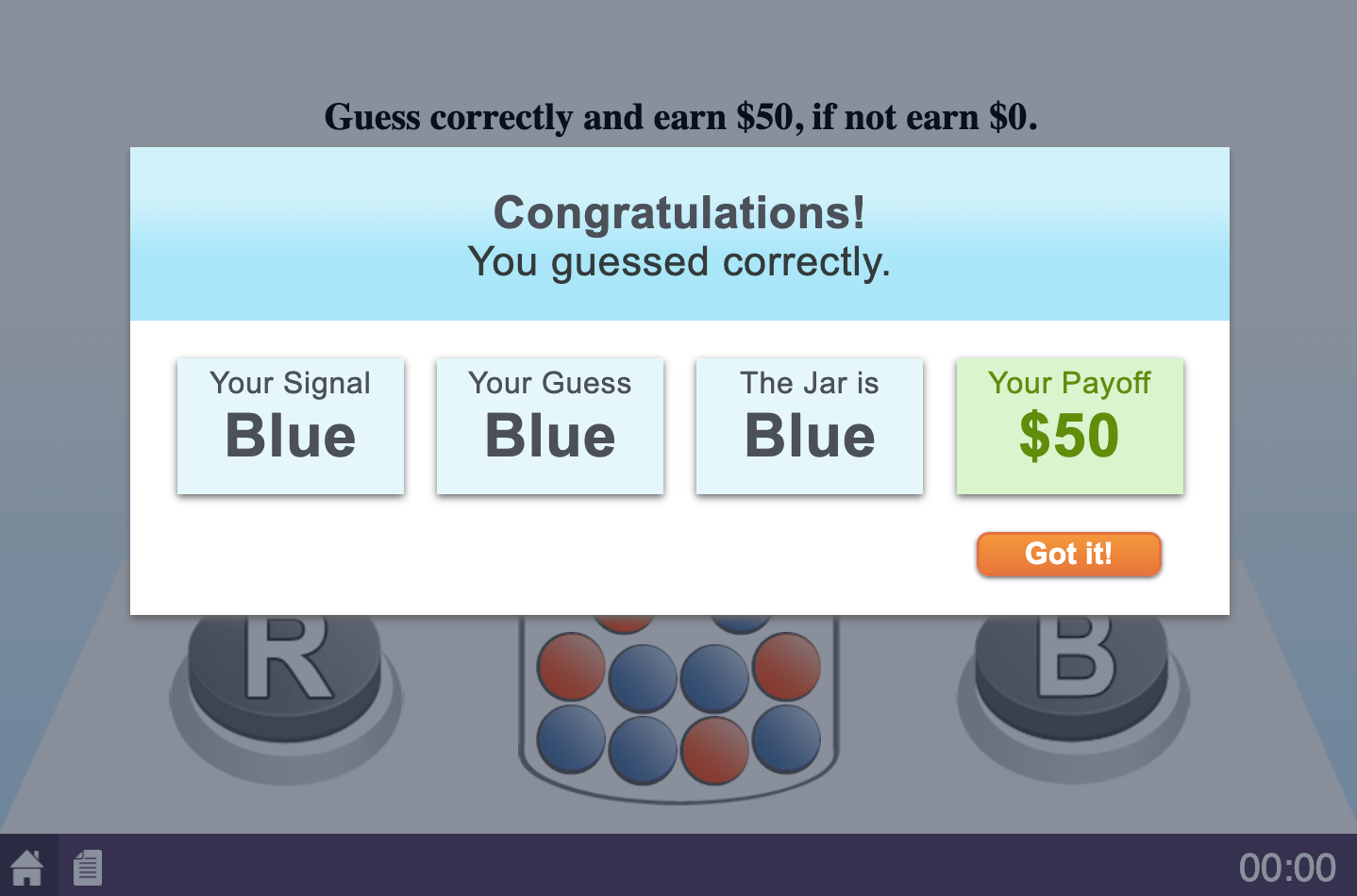

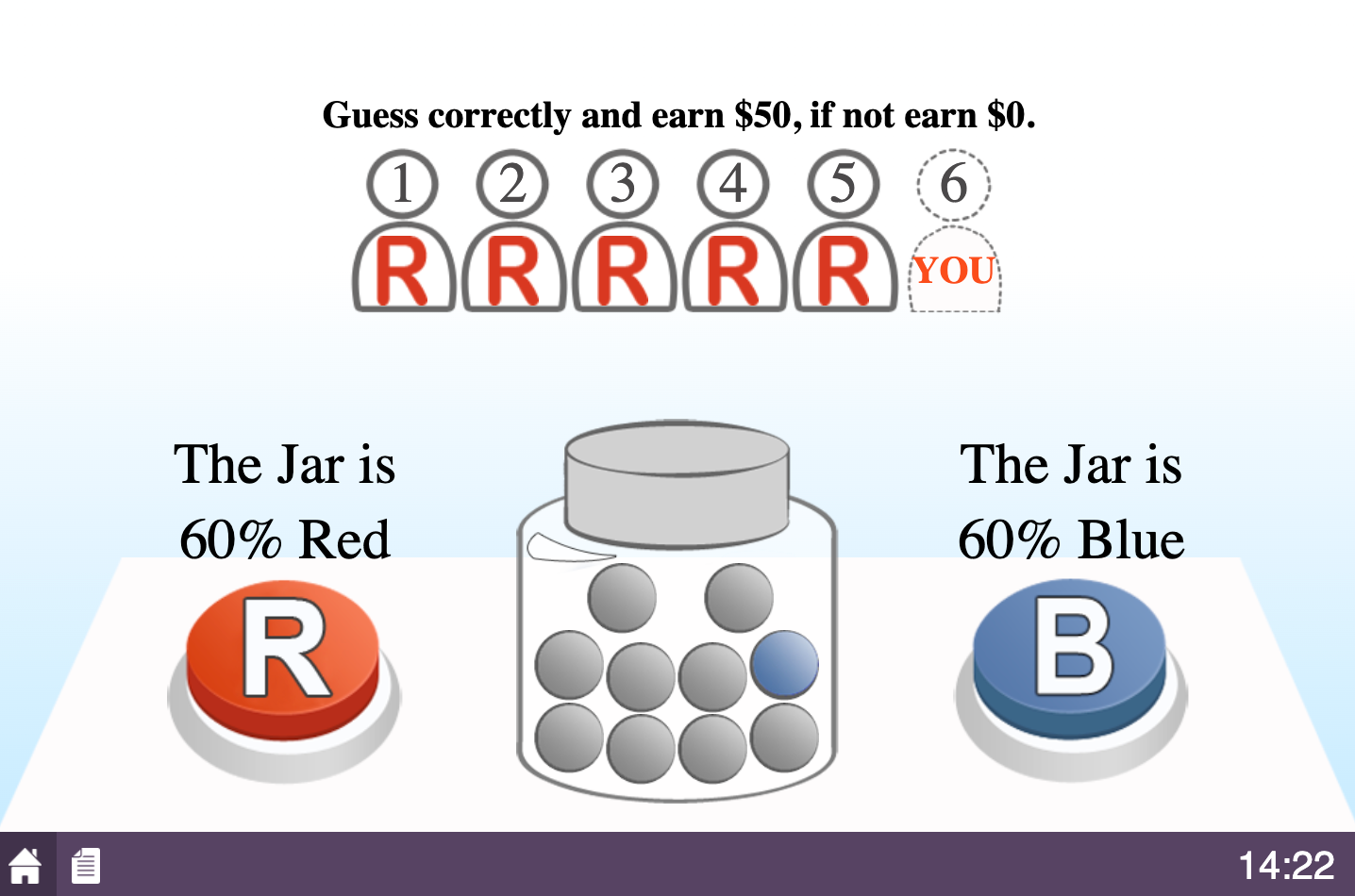

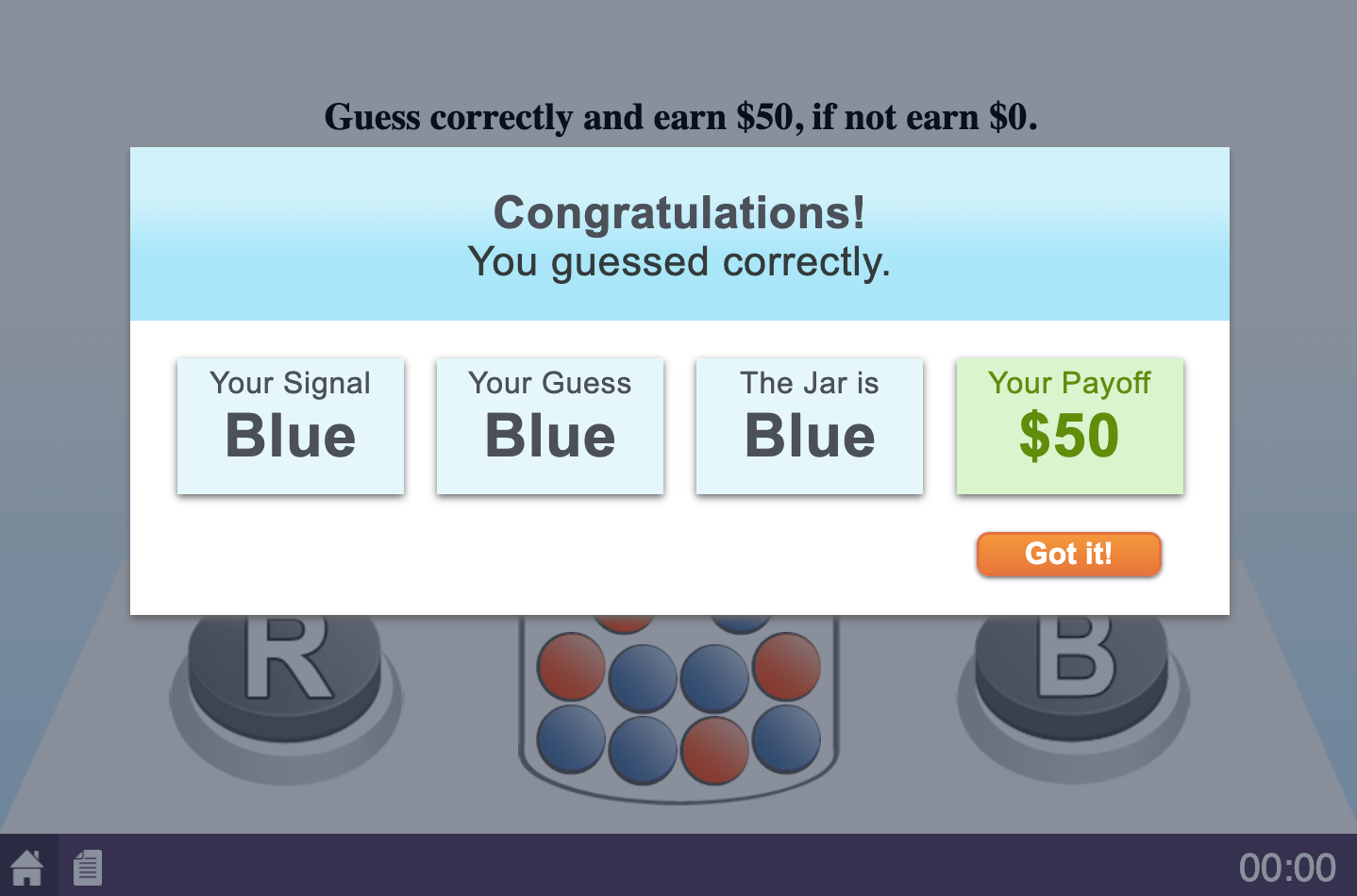

Player 6 has picked a random ball from the jar. It is a blue ball (private information). Will player 6 follow the herd by conforming to the prior guesses (red balls) of players 1 through 5? Or, will player 6 be contrarian and go against the herd’s guesses by believing in their own private information (their selection of a blue ball)? In this particular play-through, Player 6’s guess was correct by going against the herd (ignoring the public information of red guesses from players 1 through 5) and choosing blue.

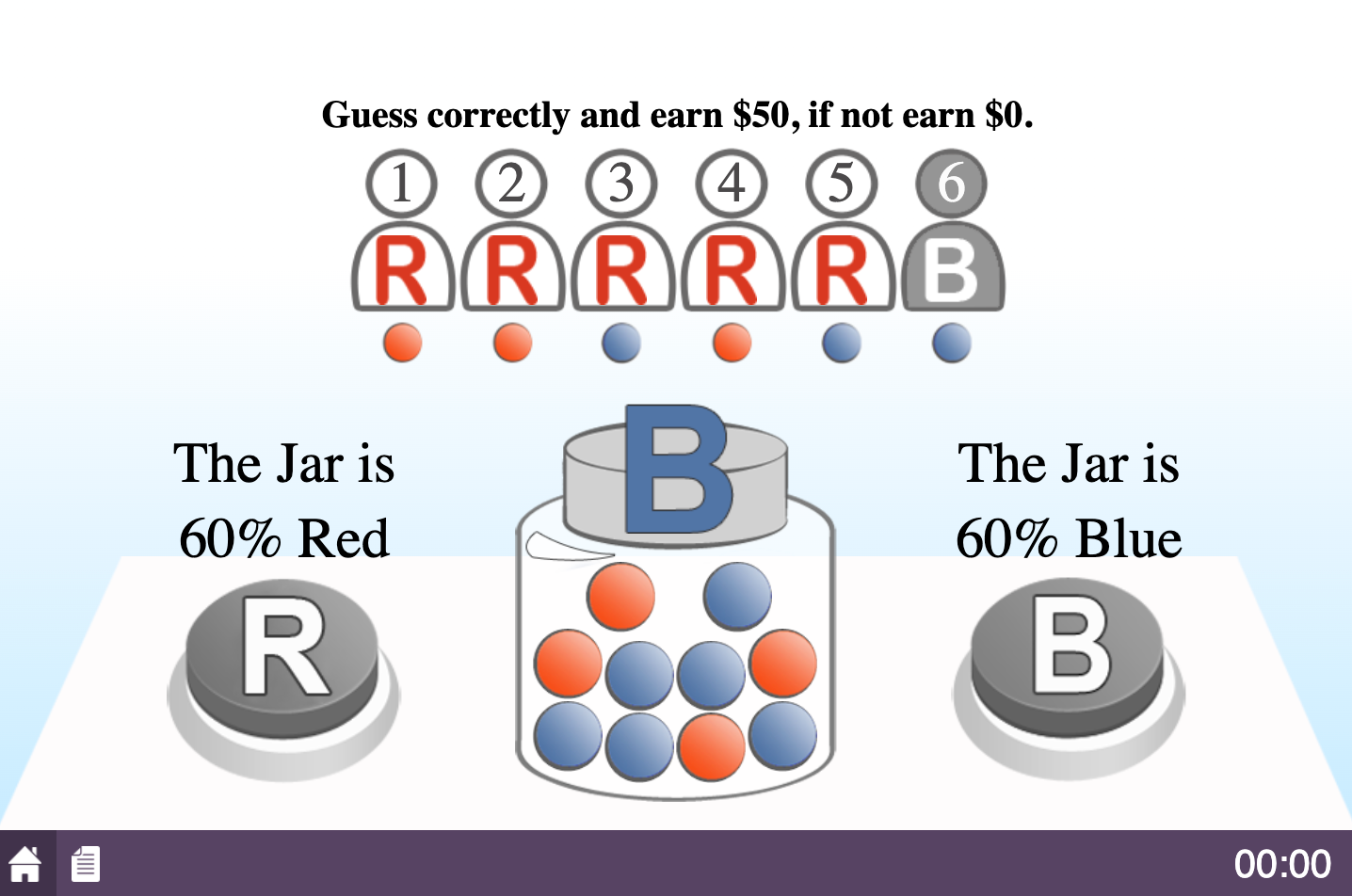

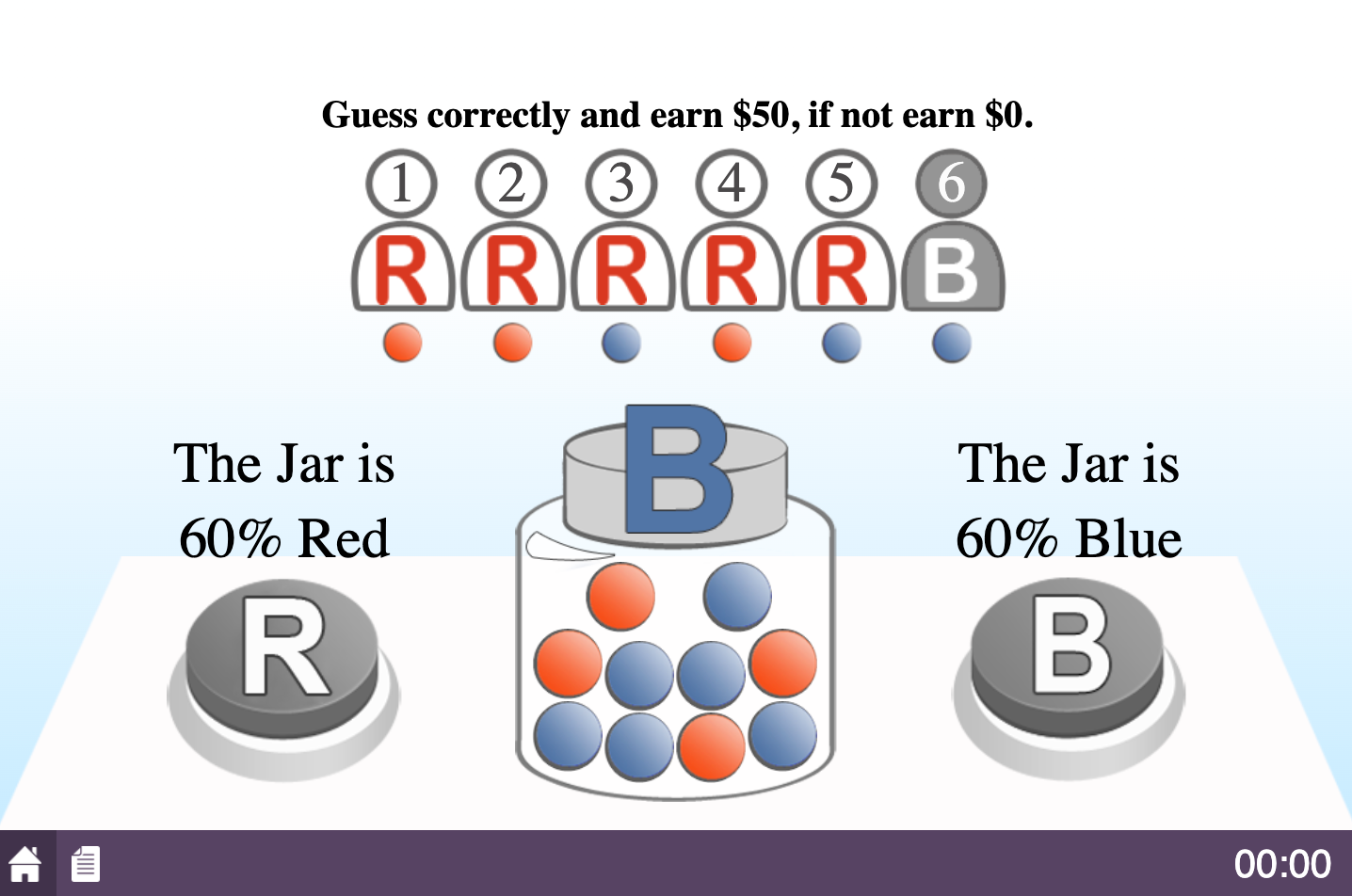

Once all players have made their guesses, the contents of the container are revealed. Note how Players 3 and 5 also selected blue balls at random, but decided to conform to the guesses of the herd instead.

In the movie The Big Short, an example of contrarian behavior is Michael Burry and his fund, Scion Capital. He and his firm bet against the housing market during the subprime bubble of 2007 to 2010. After analyzing mortgage lending practices in the early 2000’s, he believed that the housing market would collapse around 2007. Burry’s convictions against the herd, led him to short the housing market. He accomplished this by convincing Goldman Sachs, and several over financial firms, to sell him credit default swaps. These credit default swaps allowed Burry to bet against (short) the subprime housing market. Despite some of Burry’s investors doubting his analysis and convictions about the housing market, his contrarian view was correct, and he profited $100 million individually. In addition, Burry’s remaining investors in Scion Capital profited more than $700 million. The total recorded returns of Scion Capital were 489.34%.

If you want to learn more about MobLab’s economics games and learning platform, get in touch with our team to schedule a one-on-one demo meeting. Whether you’re teaching in person, online, or both, MobLab has got your class covered with many different exciting games to choose from.

Herding behavior and its associated information cascades happen in all sorts of situations: stock markets, food trends, and viral information (and misinformation) on social media are just some examples.

In the field of psychology, one notable example of conforming herding behavior is the Asch Conformity Experiments in the 1950’s. Groups of eight male college students were given a task of identifying the lengths of lines on cards. However, all the subjects were actors except one. The objective of the study was to gauge how the sole non-actor subject would react to the actor subjects’ behavior. The conclusion of the experiments was that most subjects dismissed their own private information to conform to the groups they were placed in. Approximately 75% of the experiment’s participants conformed with the rest of the group at least once. The results of these experiments are still debated to this day.

With MobLab’s Herding (Information Cascade) game, students can experience the phenomena of information cascades in the classroom.

In the Herding game, students are placed into groups and draw at random either a blue or red ball from a jar. Players do not know how many blue or red balls are inside. They individually guess if the jar contains majority blue or red balls. Individual students in the group see the guesses of other players (but not what colored ball they selected at the random drawing). Will the students make their individual guesses based on the colored ball they selected (private information) or will they be influenced by the guess made by the player(s) before their turn (public information)?

In this play-through example, the final player (Player 6) has seen the guesses of players 1 through 5. Note how players 1 through 5 all guessed red most likely based on the previous players’ red guesses (public information). This phenomena is an information cascade, and in particular, an information cascade of red ball guesses. Player 6 now needs to pick a random ball from the jar.

Player 6 has picked a random ball from the jar. It is a blue ball (private information). Will player 6 follow the herd by conforming to the prior guesses (red balls) of players 1 through 5? Or, will player 6 be contrarian and go against the herd’s guesses by believing in their own private information (their selection of a blue ball)? In this particular play-through, Player 6’s guess was correct by going against the herd (ignoring the public information of red guesses from players 1 through 5) and choosing blue.

Once all players have made their guesses, the contents of the container are revealed. Note how Players 3 and 5 also selected blue balls at random, but decided to conform to the guesses of the herd instead.

Sometimes it pays off to be contrarian like Player 6 in this play-through example… but only if you also happen to be right!

In the movie The Big Short, an example of contrarian behavior is Michael Burry and his fund, Scion Capital. He and his firm bet against the housing market during the subprime bubble of 2007 to 2010. After analyzing mortgage lending practices in the early 2000’s, he believed that the housing market would collapse around 2007. Burry’s convictions against the herd, led him to short the housing market. He accomplished this by convincing Goldman Sachs, and several over financial firms, to sell him credit default swaps. These credit default swaps allowed Burry to bet against (short) the subprime housing market. Despite some of Burry’s investors doubting his analysis and convictions about the housing market, his contrarian view was correct, and he profited $100 million individually. In addition, Burry’s remaining investors in Scion Capital profited more than $700 million. The total recorded returns of Scion Capital were 489.34%.

If you want to learn more about MobLab’s economics games and learning platform, get in touch with our team to schedule a one-on-one demo meeting. Whether you’re teaching in person, online, or both, MobLab has got your class covered with many different exciting games to choose from.