“The key to 2022 will be how inflation is brought down” - M. El-Erian, The Financial Times

Many economics instructors found it challenging to bring the concepts of monetary economics across to their students in the past decade. While central banks worldwide pursued an expansive monetary policy, price levels remained relatively stable, seemingly defying basic laws of economics as presented in textbooks. This made interest rates and inflation look like relics from the past.

Well, inflation is back in the news and affecting everyone! MobLab’s Loan Market game is a great way to introduce your students to the concept of real and nominal interest rates as well as inflation expectations.

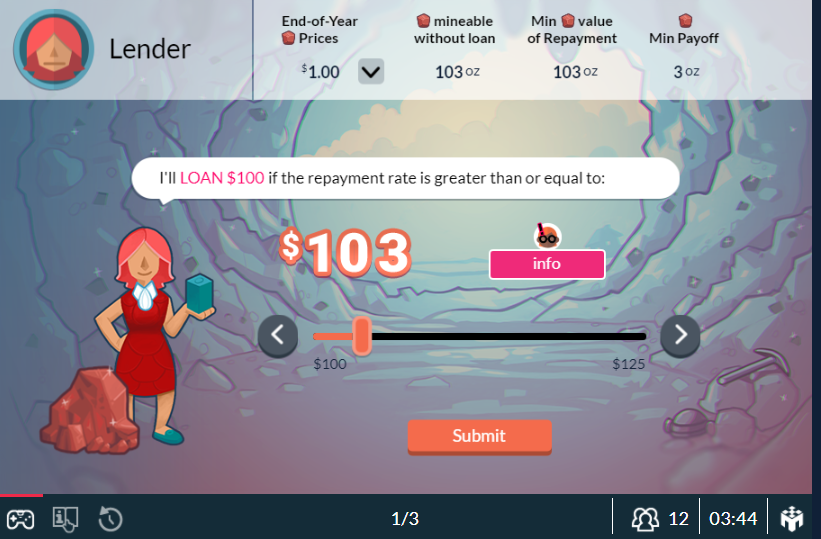

In the monetary economics game, each student has a private rate of return on a $100 investment, but only half of each group have $100. Therefore, it may be mutually beneficial for a student to loan their $100 to another student who has a higher private rate of return in exchange for a repayment amount (interest rate). The equilibrium repayment amount is determined by the intersection of lenders’ minimum acceptable and borrowers’ maximum acceptable repayment amounts.

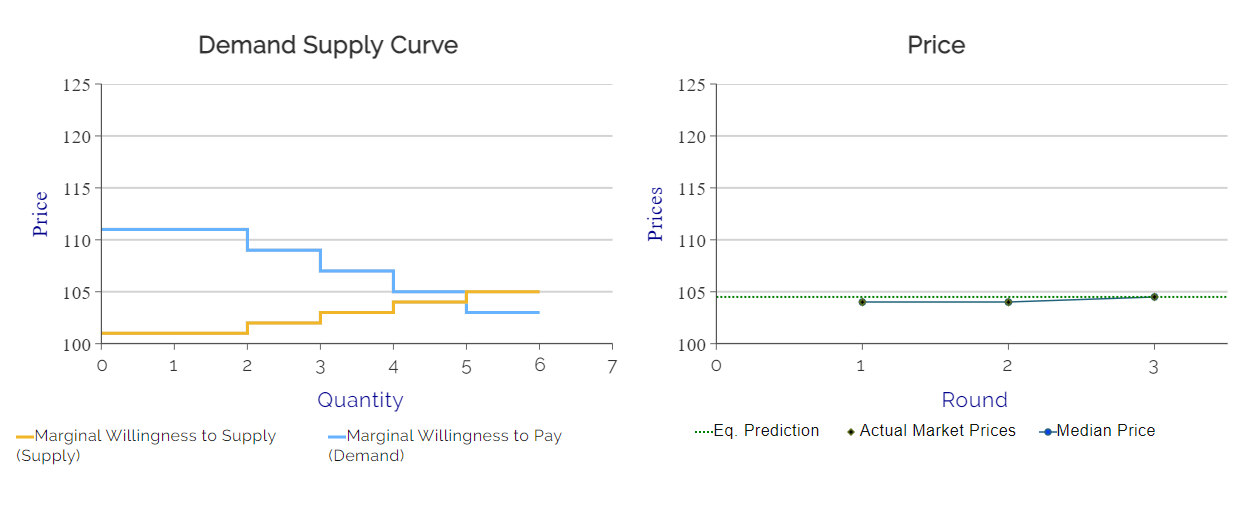

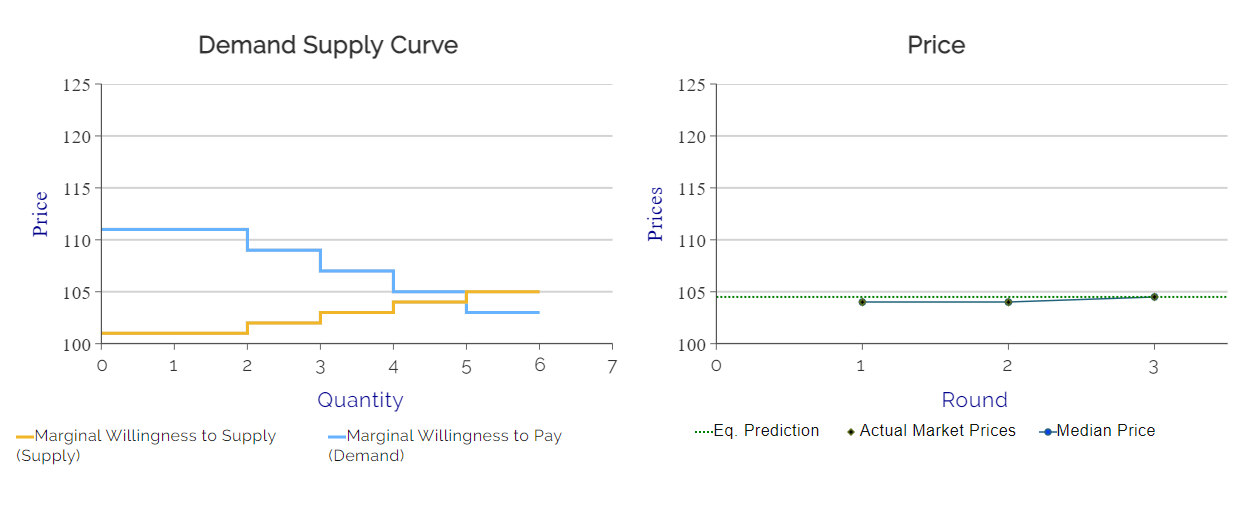

The results below illustrate how students quickly converged to the equilibrium repayment amount of $105 after 3 rounds of the monetary economics game.

The results below illustrate how students quickly converged to the equilibrium repayment amount of $105 after 3 rounds of the monetary economics game.

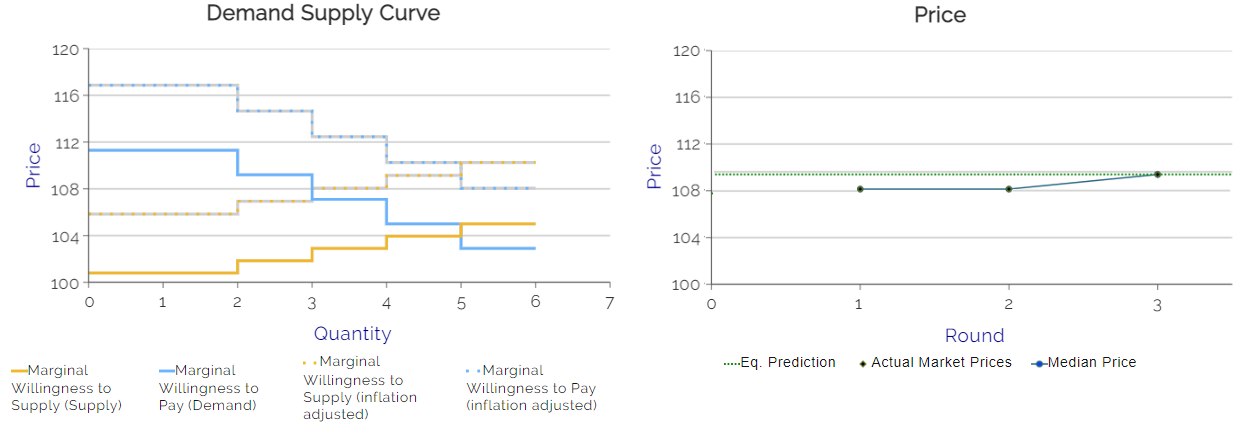

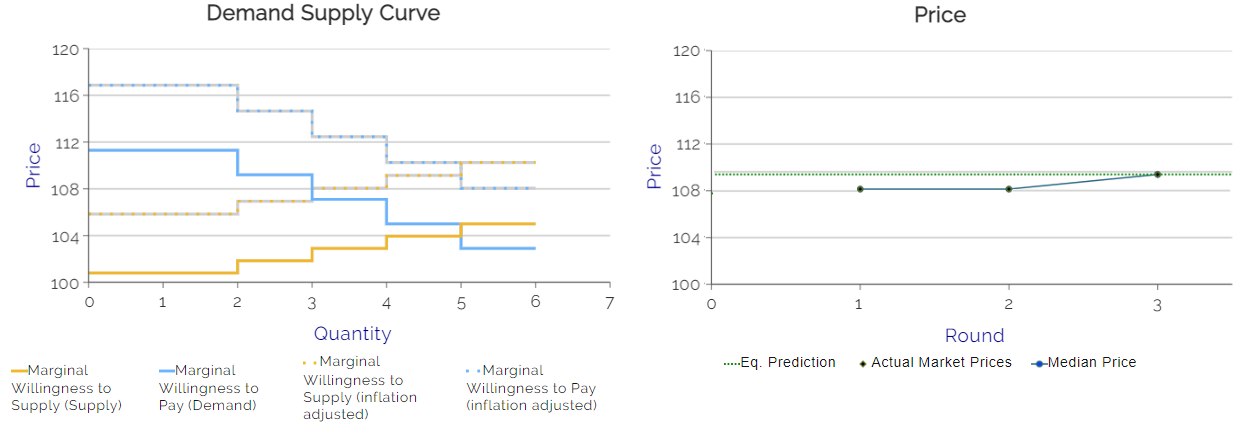

Now you can introduce inflation to demonstrate the Fisher effect, which is the tendency for nominal interest rates to change to follow the inflation rate. The results below show the outcome of 3 rounds with inflation set to 5%. Students quickly converged to a nominal interest rate of 10% approximately equal to the real interest rate plus inflation.

As a third treatment, you can now introduce uncertain inflation by entering multiple inflation rates. We recommend choosing inflation rates that have the same expectation value as the inflation in the game described previously. For example, the previous game had and Inflation Rate (in %) = 5, so we use 2, 5 and 8 percent. By setting the number of rounds to 5, we can expect that both sides will experience an inflation rate that is higher than expected and lower than expected. This produces wins and losses for both borrowers and lenders.

As a third treatment, you can now introduce uncertain inflation by entering multiple inflation rates. We recommend choosing inflation rates that have the same expectation value as the inflation in the game described previously. For example, the previous game had and Inflation Rate (in %) = 5, so we use 2, 5 and 8 percent. By setting the number of rounds to 5, we can expect that both sides will experience an inflation rate that is higher than expected and lower than expected. This produces wins and losses for both borrowers and lenders.

If you don’t have an account, create one. It’s commitment-free and gives you access to all MobLab materials. Caught the inflation fever? Get in touch and we would be happy to give you a personalized tour of the MobLab economics game platform.

Many economics instructors found it challenging to bring the concepts of monetary economics across to their students in the past decade. While central banks worldwide pursued an expansive monetary policy, price levels remained relatively stable, seemingly defying basic laws of economics as presented in textbooks. This made interest rates and inflation look like relics from the past.

Well, inflation is back in the news and affecting everyone! MobLab’s Loan Market game is a great way to introduce your students to the concept of real and nominal interest rates as well as inflation expectations.

In the monetary economics game, each student has a private rate of return on a $100 investment, but only half of each group have $100. Therefore, it may be mutually beneficial for a student to loan their $100 to another student who has a higher private rate of return in exchange for a repayment amount (interest rate). The equilibrium repayment amount is determined by the intersection of lenders’ minimum acceptable and borrowers’ maximum acceptable repayment amounts.

Game Results with equilibrium interest rate of 5%

Now you can introduce inflation to demonstrate the Fisher effect, which is the tendency for nominal interest rates to change to follow the inflation rate. The results below show the outcome of 3 rounds with inflation set to 5%. Students quickly converged to a nominal interest rate of 10% approximately equal to the real interest rate plus inflation.