Want to excite your students for your principles of economics class this upcoming semester? Why not tease the study of markets and their ability to aggregate information through the recent hype around Elon Musk’s attempt to take over Twitter.

One of the ten agreed principles of economics is that markets are usually a good way to organize economic activity. But why? Markets act not only as a platform in which goods, assets, (crypto-)currencies, etc. are exchanged but also in which information is aggregated through the prices at which people are willing to transact. This is especially so in cases where the intrinsic value of an asset is not obvious. One case of that is the stock market. The price of a stock can be interpreted as an indicator for what people belief the underlying value of a good, asset, etc. is. As new information arises, the price adjusts accordingly. However, in the particular case of attempted mergers, there exists a spread between the takeover offer and the current stock trading price. We can interpret the difference between the stock’s trading price and the takeover bid as an assessment of the public’s belief concerning the likelihood of the merger. You can think of this as a kind of wisdom of the crowds’ approach in situations where it is difficult to predict the future (basically in all cases).

As recently described by the Economist, this situation has become an interesting investment playground for hedge funds. In cases where there is a believed low chance of the merger – as evidence by a relatively low market stock price – hedge funds buy or increase their holding to receive the payoff when the merger does go through at the higher merger offer price. This behavior is speculative in the sense that a current stock purchase is done in the hopes of reselling at a later stage because of the current volatile market activity. This situation can have two outcomes, the merger comes through, and the market price will soar to the merger price, or the merger does not go through and stock prices do not reach that profitable merger price.

MobLab’s Answer

Interesting as it is in and of itself, how can you help your students understand mergers using MobLab economics games? We are glad you asked! As your students are likely already on Twitter anyway, our Asset Market game can provide your point of connection with your students over something they will immediately consider relevant.

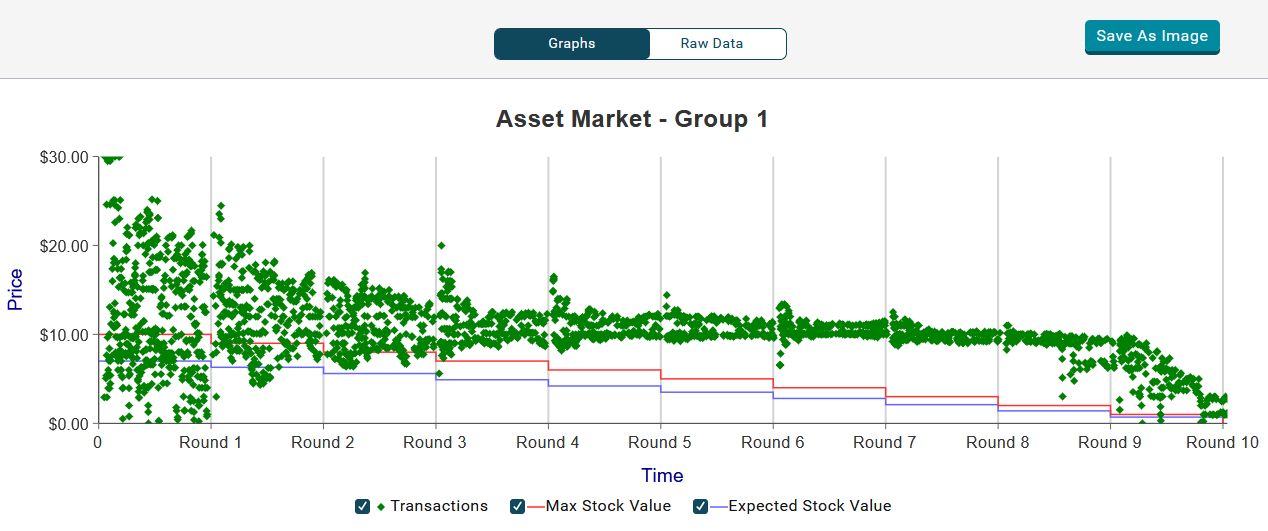

Interface of Asset Market Game

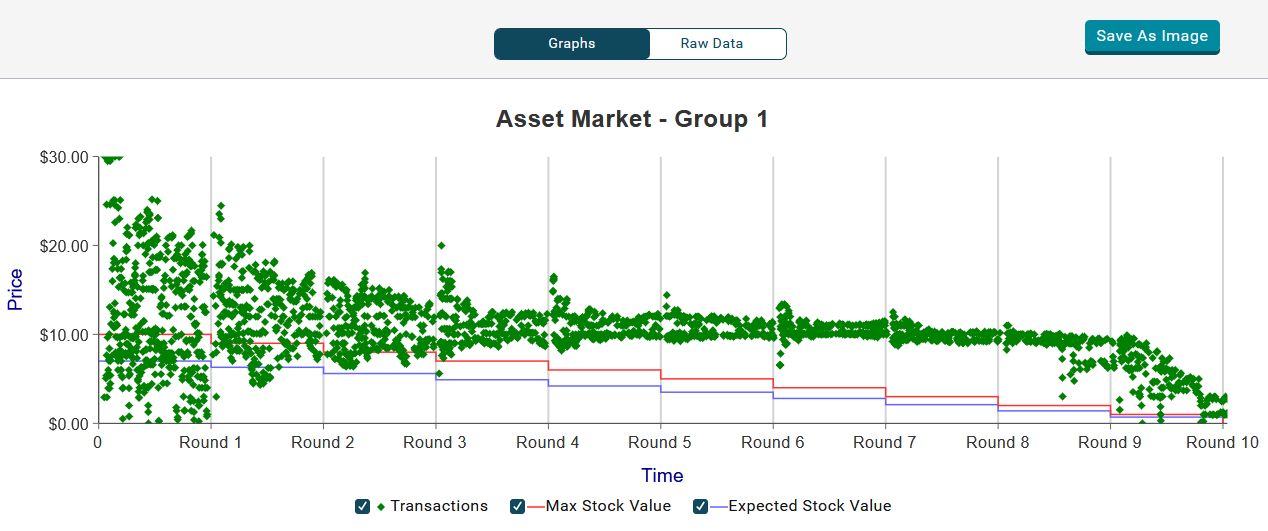

In this game students hold several assets over several finite periods, say 10, and each round the asset pays a high or low dividend with equal probability. If expected value was the valuation method of all participants, the underlying value would be easy to calculate. Typically, though, students experience the formation of a bubble where assets are sold and bought at prices far above the fundamental value and towards the last rounds this bubble collapses and prices stabilize at the fundamental value.

Results from in-class session with 115 Students

The underlying logic of the game is that if there is a reasonable belief of reselling the asset at a later stage at a higher price, it is both rational and profitable to buy the asset in the current market state. This works as long as there are people willing to buy and sell the assets where each transaction informs sellers and buyers about the state of belief of at least those two buyers and sellers. This is of course where the game is like the current market situation of Twitter. Both the Hedge fund manager and students are in fact betting on a future increase of the stock price, to obtain a higher a payoff. For both there will come a time of reckoning in which this future stock price increase will be realized or not.

So why not reach out to us about our Asset Market Game or any other MobLab activity for your upcoming economics course? We would be happy to set you and your students up to embark on the journey you have prepared for them this semester.

One of the ten agreed principles of economics is that markets are usually a good way to organize economic activity. But why? Markets act not only as a platform in which goods, assets, (crypto-)currencies, etc. are exchanged but also in which information is aggregated through the prices at which people are willing to transact. This is especially so in cases where the intrinsic value of an asset is not obvious. One case of that is the stock market. The price of a stock can be interpreted as an indicator for what people belief the underlying value of a good, asset, etc. is. As new information arises, the price adjusts accordingly. However, in the particular case of attempted mergers, there exists a spread between the takeover offer and the current stock trading price. We can interpret the difference between the stock’s trading price and the takeover bid as an assessment of the public’s belief concerning the likelihood of the merger. You can think of this as a kind of wisdom of the crowds’ approach in situations where it is difficult to predict the future (basically in all cases).

As recently described by the Economist, this situation has become an interesting investment playground for hedge funds. In cases where there is a believed low chance of the merger – as evidence by a relatively low market stock price – hedge funds buy or increase their holding to receive the payoff when the merger does go through at the higher merger offer price. This behavior is speculative in the sense that a current stock purchase is done in the hopes of reselling at a later stage because of the current volatile market activity. This situation can have two outcomes, the merger comes through, and the market price will soar to the merger price, or the merger does not go through and stock prices do not reach that profitable merger price.

MobLab’s Answer

Interesting as it is in and of itself, how can you help your students understand mergers using MobLab economics games? We are glad you asked! As your students are likely already on Twitter anyway, our Asset Market game can provide your point of connection with your students over something they will immediately consider relevant.

Interface of Asset Market Game

Results from in-class session with 115 Students

So why not reach out to us about our Asset Market Game or any other MobLab activity for your upcoming economics course? We would be happy to set you and your students up to embark on the journey you have prepared for them this semester.