New! Online Assignment for Teaching Taxes

Taxes are a widely discussed (and debated) issue across the globe. All governments use taxes to raise revenue for public projects, such as roads, schools, and national defense. As the government implements a tax, questions arise: who bears the burden of the tax? The buyers in the market? The sellers in the market? MobLab activities are an effective way to explore these questions.

Now, we are excited to share with you the ready-made Online Assignment on Taxes. This new Online Assignment contains a sequence of multiple tax games and activities for your students to complete at their own pace. These include video instructions for the competitive market game, the game itself with a tax on sellers, and follow-up surveys to discuss game results and reflect on their decisions.

Players will experience what happens when a tax is imposed on the seller. They'll learn that regardless of who is nominally paying the tax, the burden is shared by both parties and supply and demand will reach the same result either way, according to the laws of elasticity rather than the laws of congress.

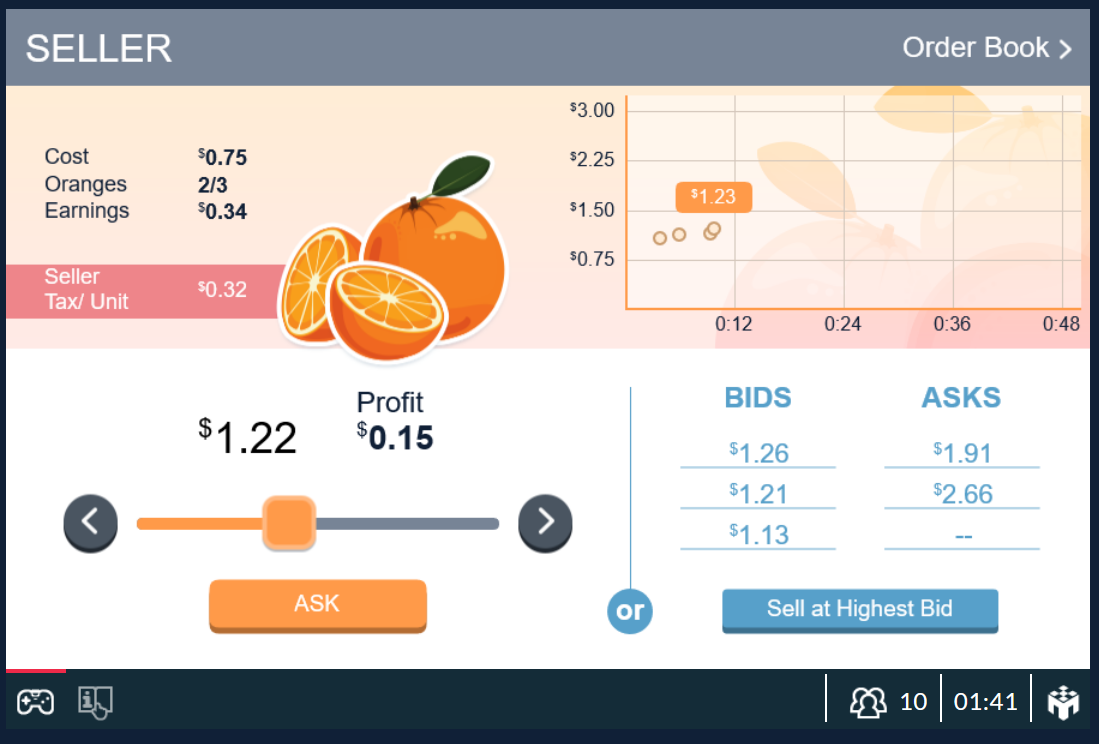

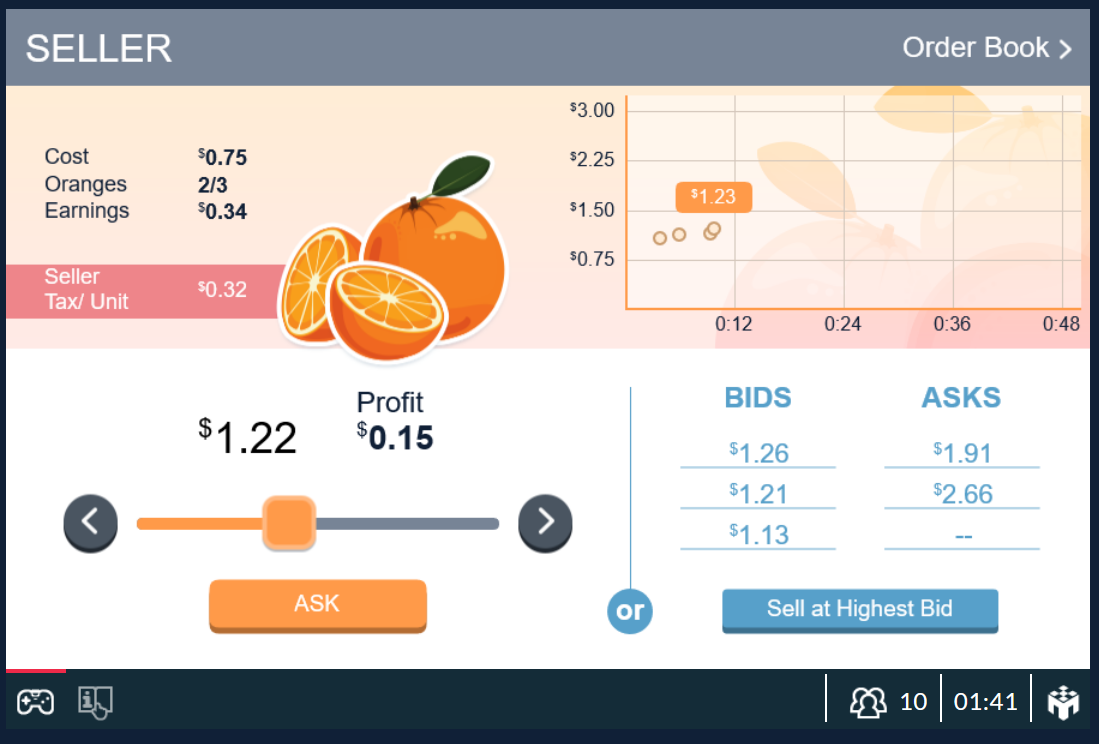

Seller Game Screen with Seller’s Tax/Unit of $0.32

Our Taxes Online Assignment includes a brief refresher on the Competitive Market Game with no tax. This is followed by a short debrief survey which guides the student into a Market with a Tax on Sellers. Following the second game, students view some sample results and are debriefed on their experience within the game as it pertains to market outcomes.

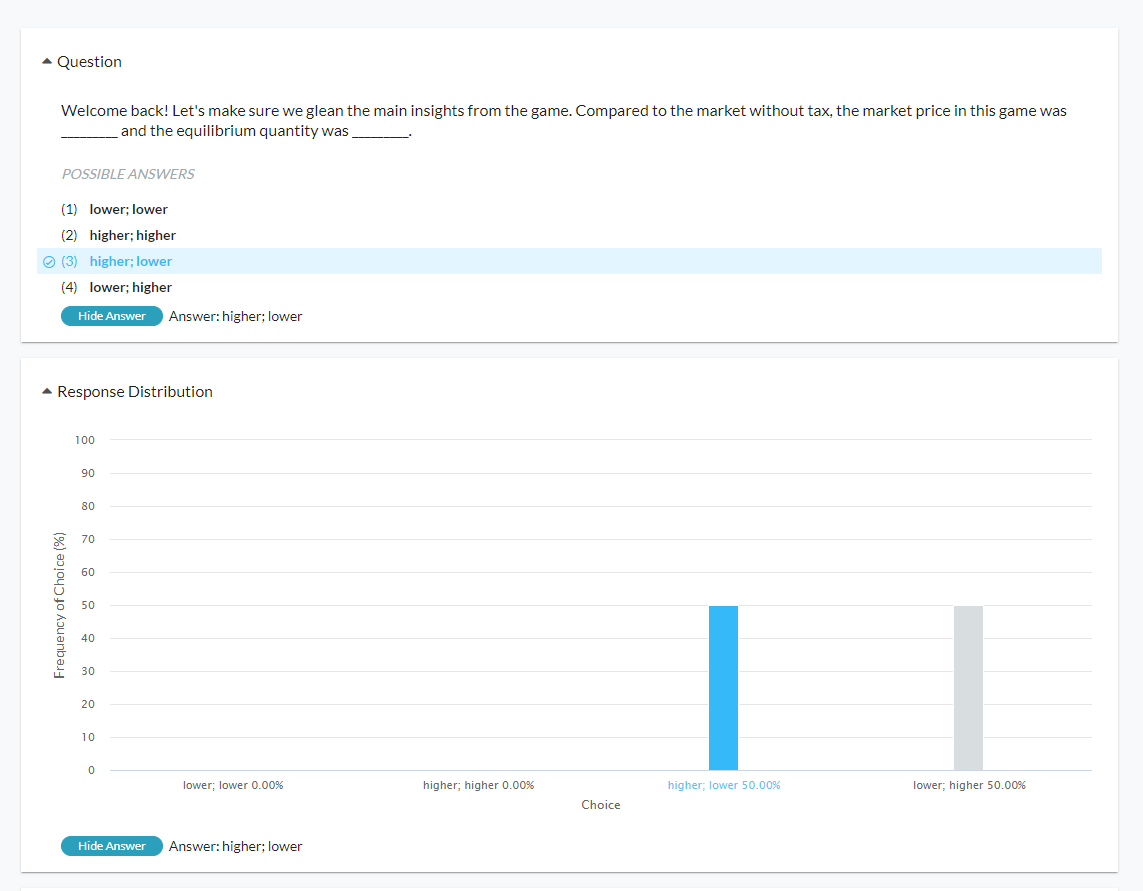

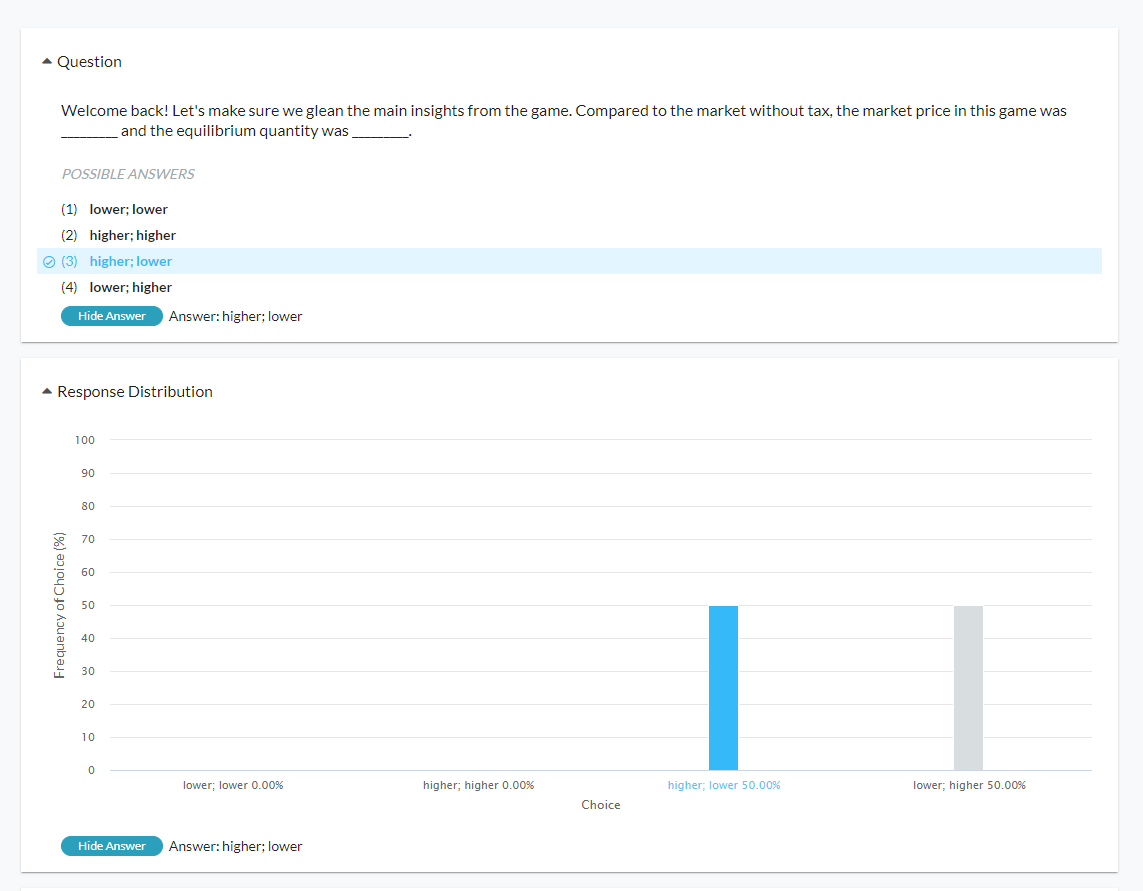

Example survey question to debrief students

Highlight of the Assignment

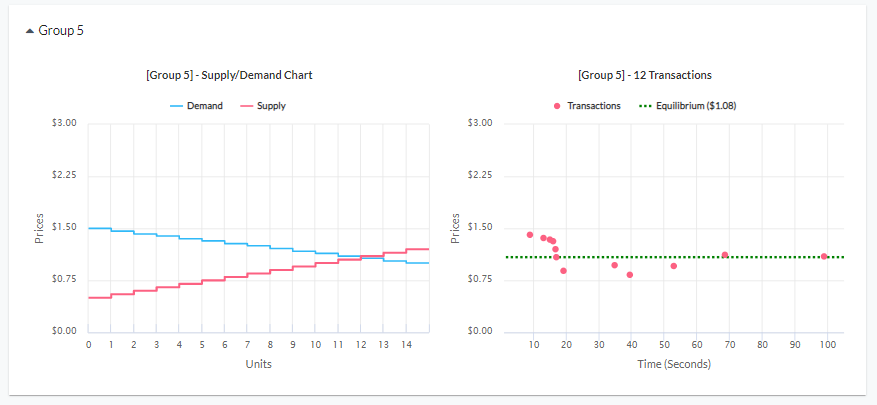

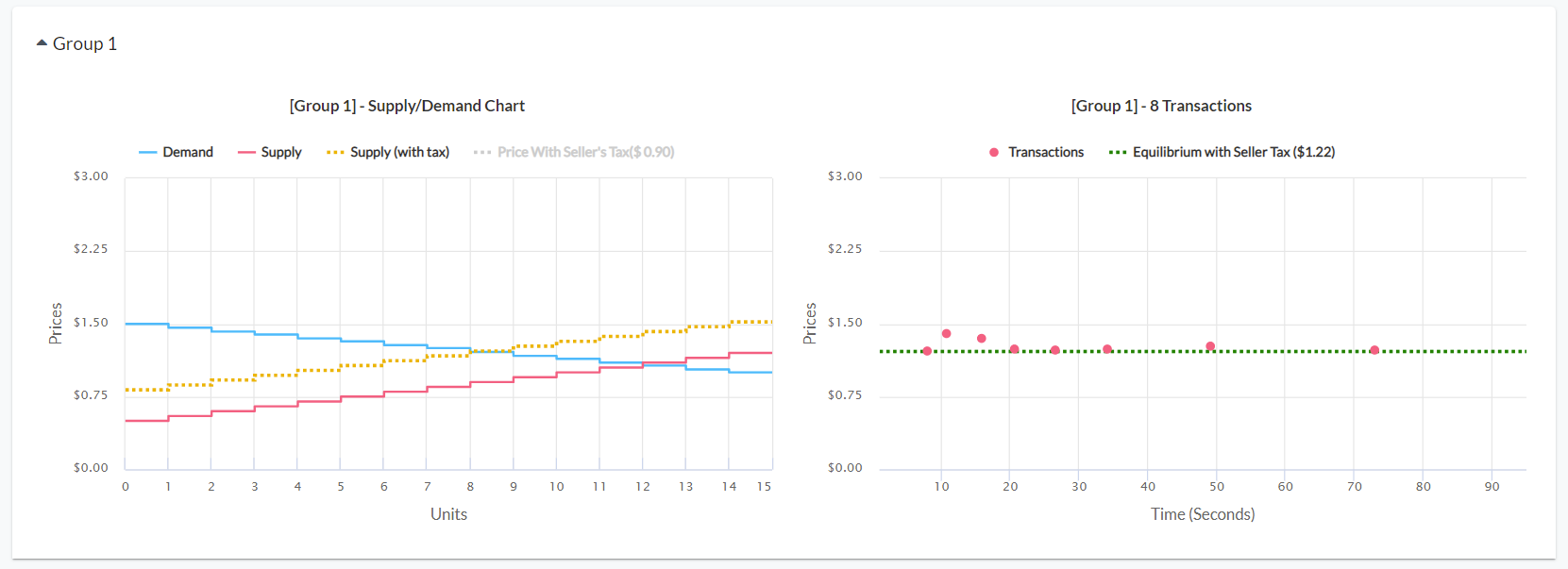

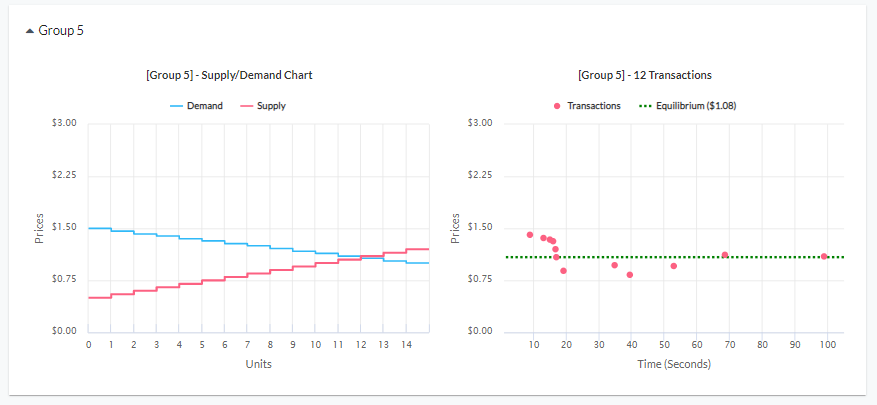

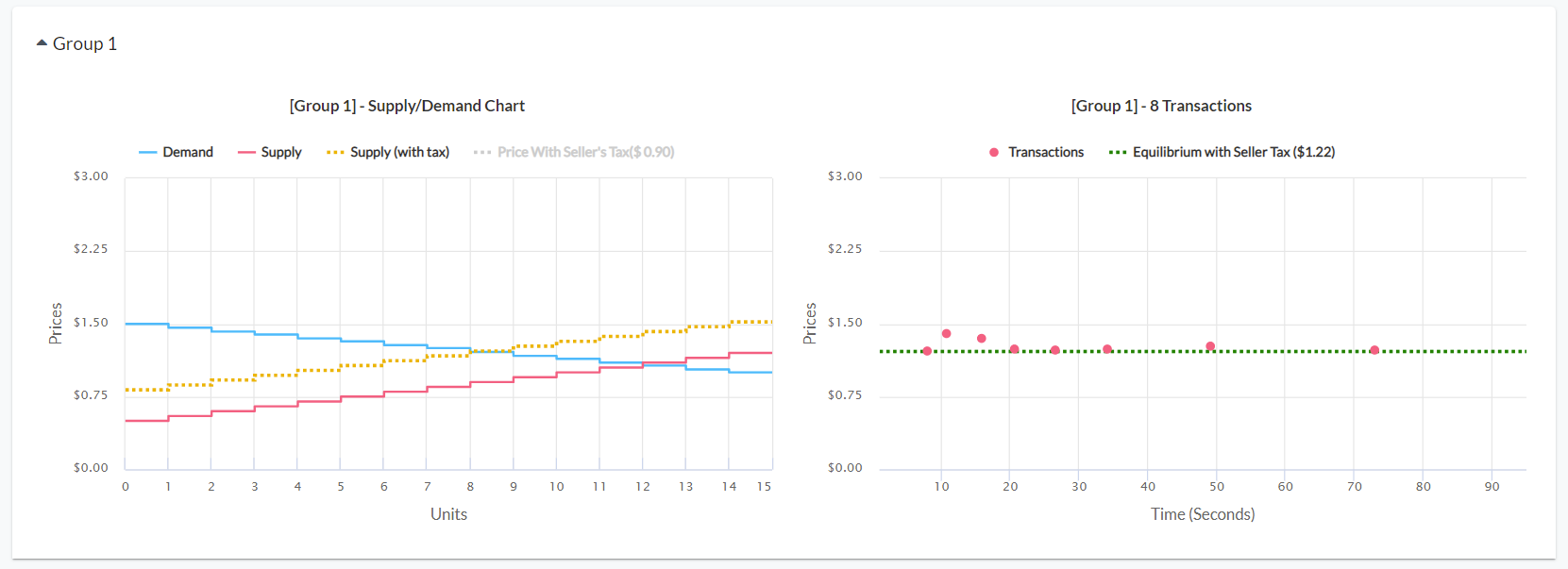

The objectives of this Online Assignment are to shine light on the differences between markets with a tax vs. markets with no tax but to show the burden is shared by both parties (seller & buyer). Figure 1 depicts sample results of the first game that your students play through. Figure 2 depicts sample results of that same market but with a $0.32 tax on sellers. The graph on the left of Figure 2 shows a supply curve shifted up at each unit, resulting in a new equilibrium.

Figure 1: Sample results of a market with no tax

Figure 2: Sample results of a market with a tax on sellers

In addition to the games, the next section of the assignment covers a general concept review of tax incidence. This includes a wonderful video overview from our friends at Marginal Revolution University, followed by several assessment questions. The final sections of the assignment consist of some key takeaways from the lessons.

Would you like to learn more about our online economics games? Get in touch with our team. Whether you’re teaching in person, online, or both, MobLab has got you covered with Online Assignments for asynchronous learning. Click here to schedule a one on one demo meeting.

Taxes are a widely discussed (and debated) issue across the globe. All governments use taxes to raise revenue for public projects, such as roads, schools, and national defense. As the government implements a tax, questions arise: who bears the burden of the tax? The buyers in the market? The sellers in the market? MobLab activities are an effective way to explore these questions.

Now, we are excited to share with you the ready-made Online Assignment on Taxes. This new Online Assignment contains a sequence of multiple tax games and activities for your students to complete at their own pace. These include video instructions for the competitive market game, the game itself with a tax on sellers, and follow-up surveys to discuss game results and reflect on their decisions.

Players will experience what happens when a tax is imposed on the seller. They'll learn that regardless of who is nominally paying the tax, the burden is shared by both parties and supply and demand will reach the same result either way, according to the laws of elasticity rather than the laws of congress.

Seller Game Screen with Seller’s Tax/Unit of $0.32

Example survey question to debrief students

The objectives of this Online Assignment are to shine light on the differences between markets with a tax vs. markets with no tax but to show the burden is shared by both parties (seller & buyer). Figure 1 depicts sample results of the first game that your students play through. Figure 2 depicts sample results of that same market but with a $0.32 tax on sellers. The graph on the left of Figure 2 shows a supply curve shifted up at each unit, resulting in a new equilibrium.

Figure 1: Sample results of a market with no tax

Figure 2: Sample results of a market with a tax on sellers

Would you like to learn more about our online economics games? Get in touch with our team. Whether you’re teaching in person, online, or both, MobLab has got you covered with Online Assignments for asynchronous learning. Click here to schedule a one on one demo meeting.