Double marginalization can be a tricky concept for students to grasp. How can a merger benefit both the industry and the consumer? This idea may seem completely counterintuitive for students. With MobLab’s Double Marginalization game, students explore this concept in a way that might help them better understand the theory.

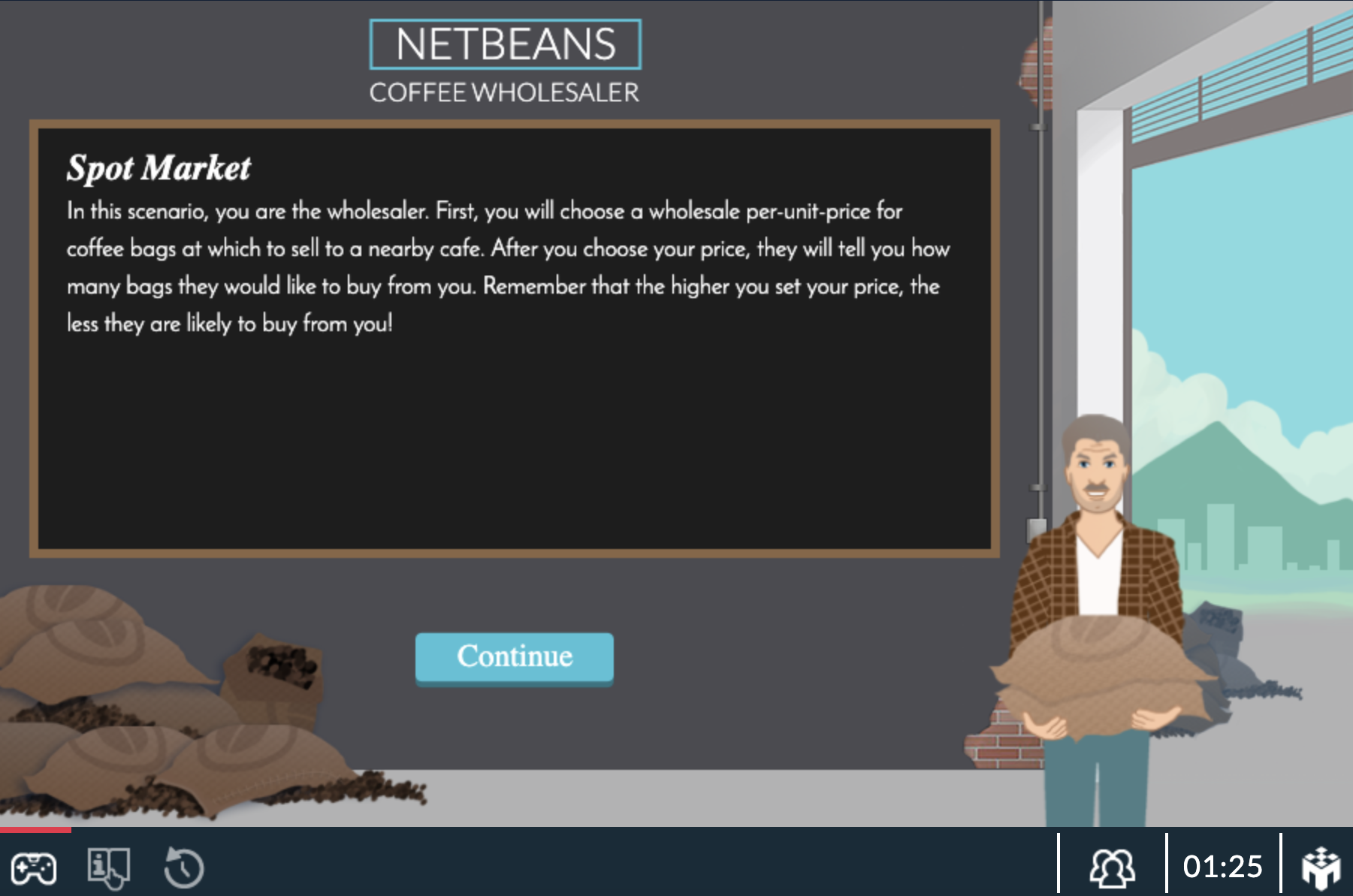

Wholesaler (left) and Retailer (right) Spot Market Game Screens

In this game, the double marginalization problem is demonstrated using a coffee supply chain. Students take the role of either a wholesale coffee roaster or a retail café. The wholesalers set a price per bag of coffee, and given that price, the retailers then decide how much coffee to buy. Since the wholesaler and retailer are in the same supply chain but at different vertical levels, the double marginalization problem occurs when both the wholesaler and the retailer mark up their prices, decreasing profits for each entity and reducing consumer surplus in the market. Beyond just demonstrating the double marginalization problem, the game also allows for instructors to play around with a few key treatment variations. The game offers three different integration types:

Spot Market Merger & Acquisition Franchise

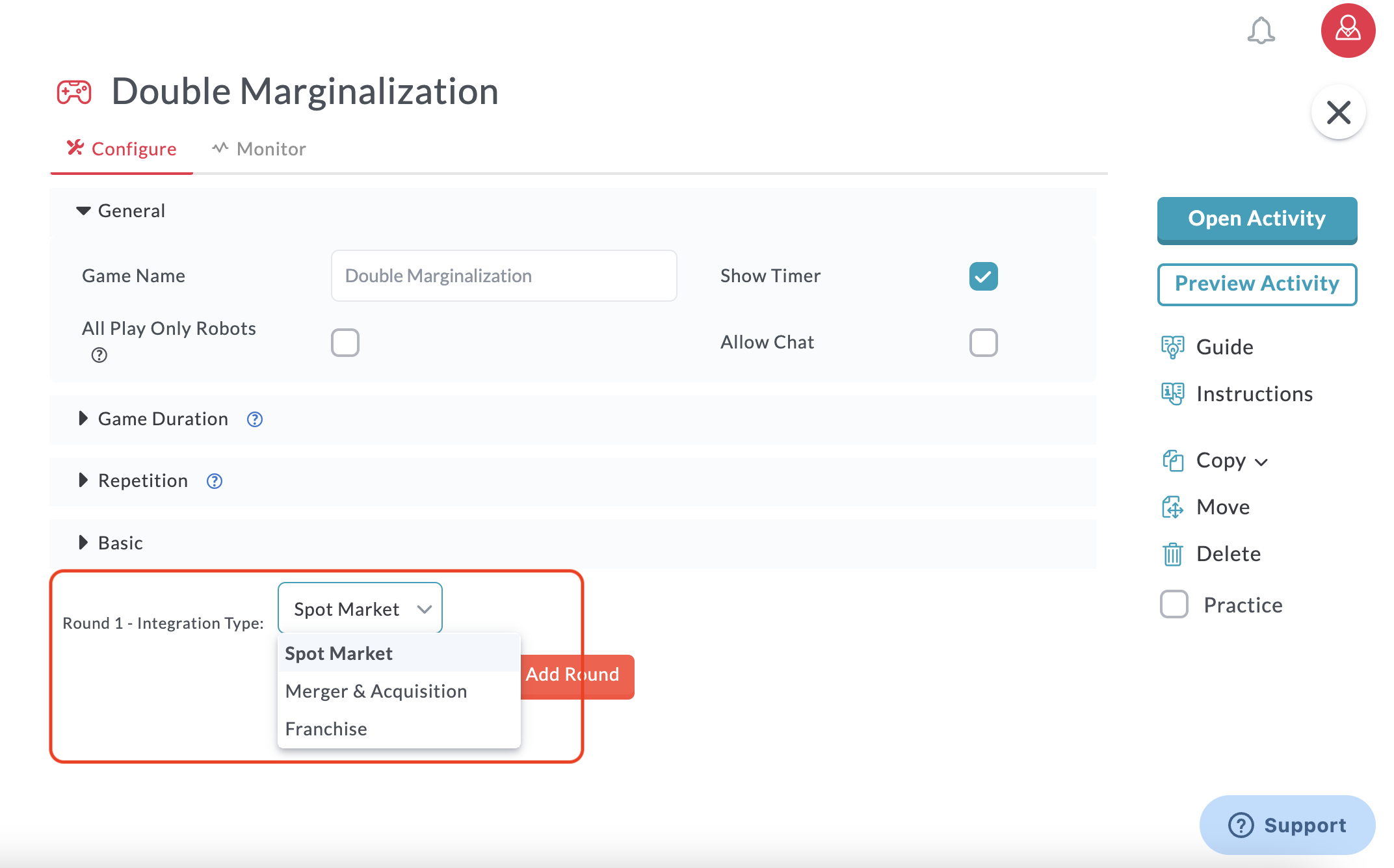

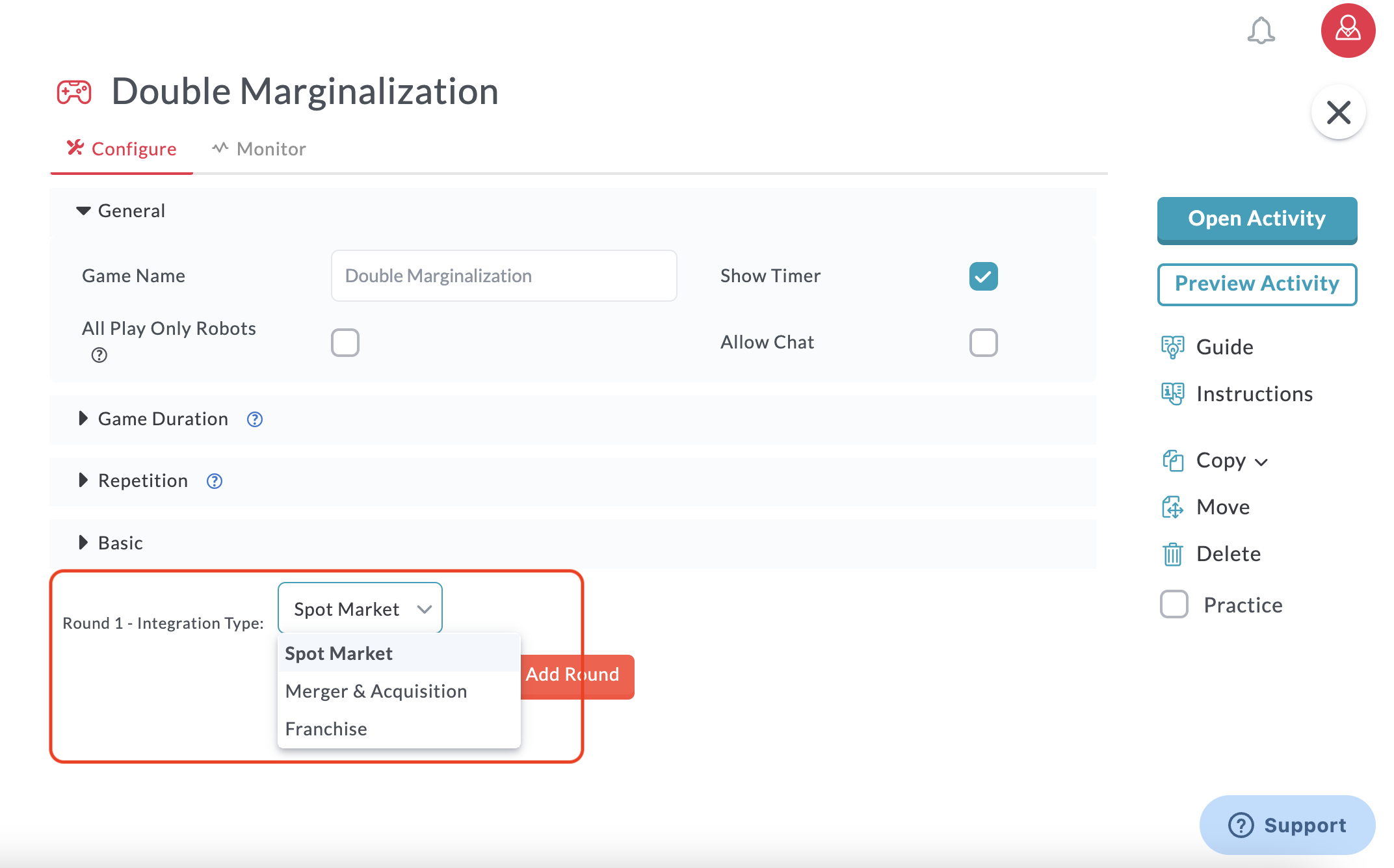

Double Marginalization configurations on the instructor console

Spot Market

The Spot Market setting puts students into a market where the wholesaler and retailer are operating as independent entities at different points along the same supply chain. The wholesaler proposes a price for a bag of coffee beans and the retailer responds with the quantity of bags they would like to purchase at the proposed price. In this market, profit is the name of the game and each entity is seeking to maximize its own profit. This scenario illustrates that the double mark up that occurs would result in a higher price for the consumer since each entity wants to increase their own profit.

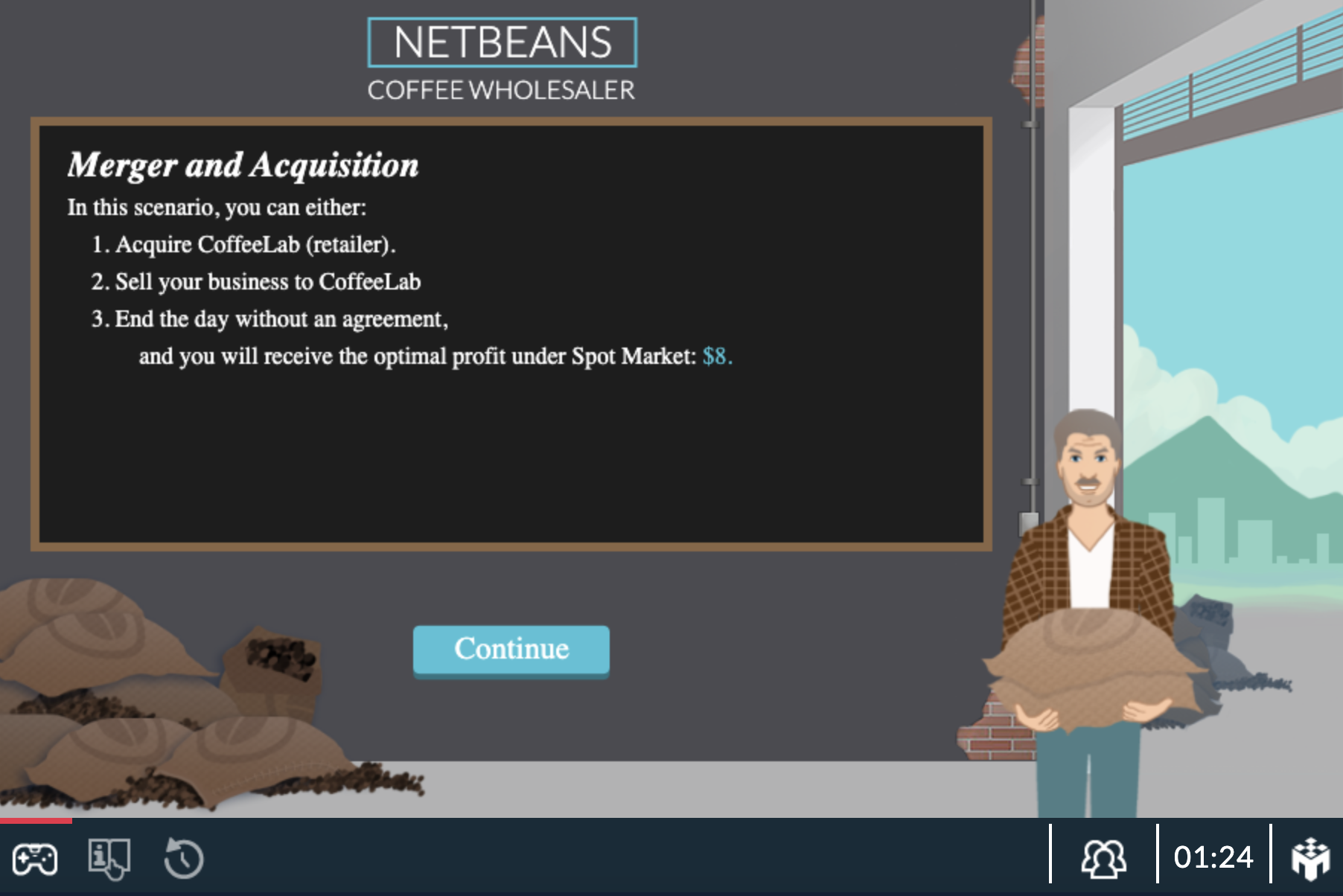

Merger & Acquisition

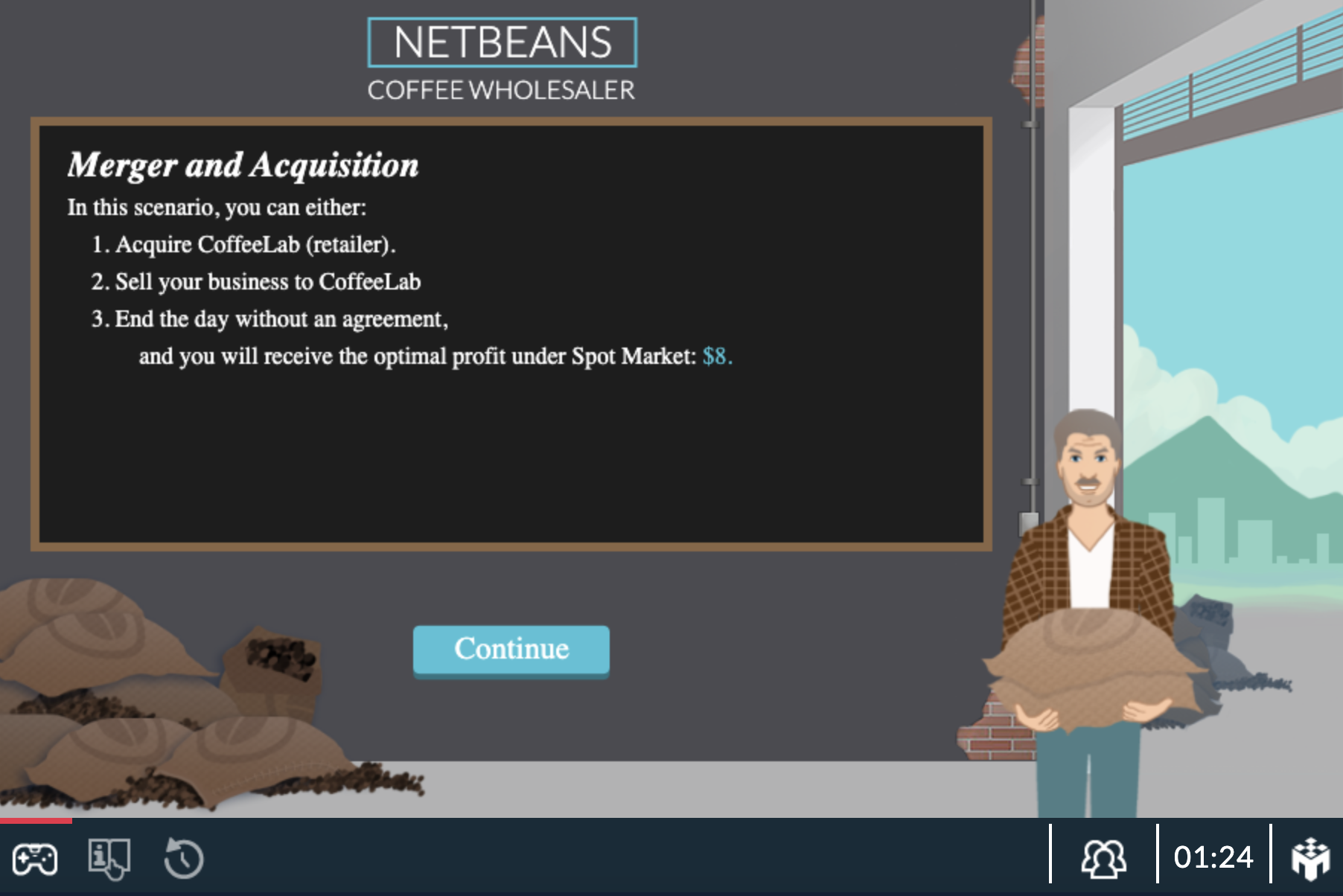

When the vertical integration setting is selected (Merger & Acquisition), students are allowed to participate in free form bargaining. Both the wholesaler and the retailer can submit offers to acquire the other entity. Each party has the ability to accept or decline any offers. If an offer is accepted, the acquired firm receives a payment equal to the proposal and the merged firm now faces market demand as a monopolist. If an offer is rejected, there is an opportunity to make a counteroffer, but, if no agreement is reached by the time the game is up, both the wholesaler and the retailer end up with the optimal profit in the Spot Market. Selecting this setting shows students one solution to the double marginalization problem.

Wholesaler and Retailer Merger & Acquisition Game Screen

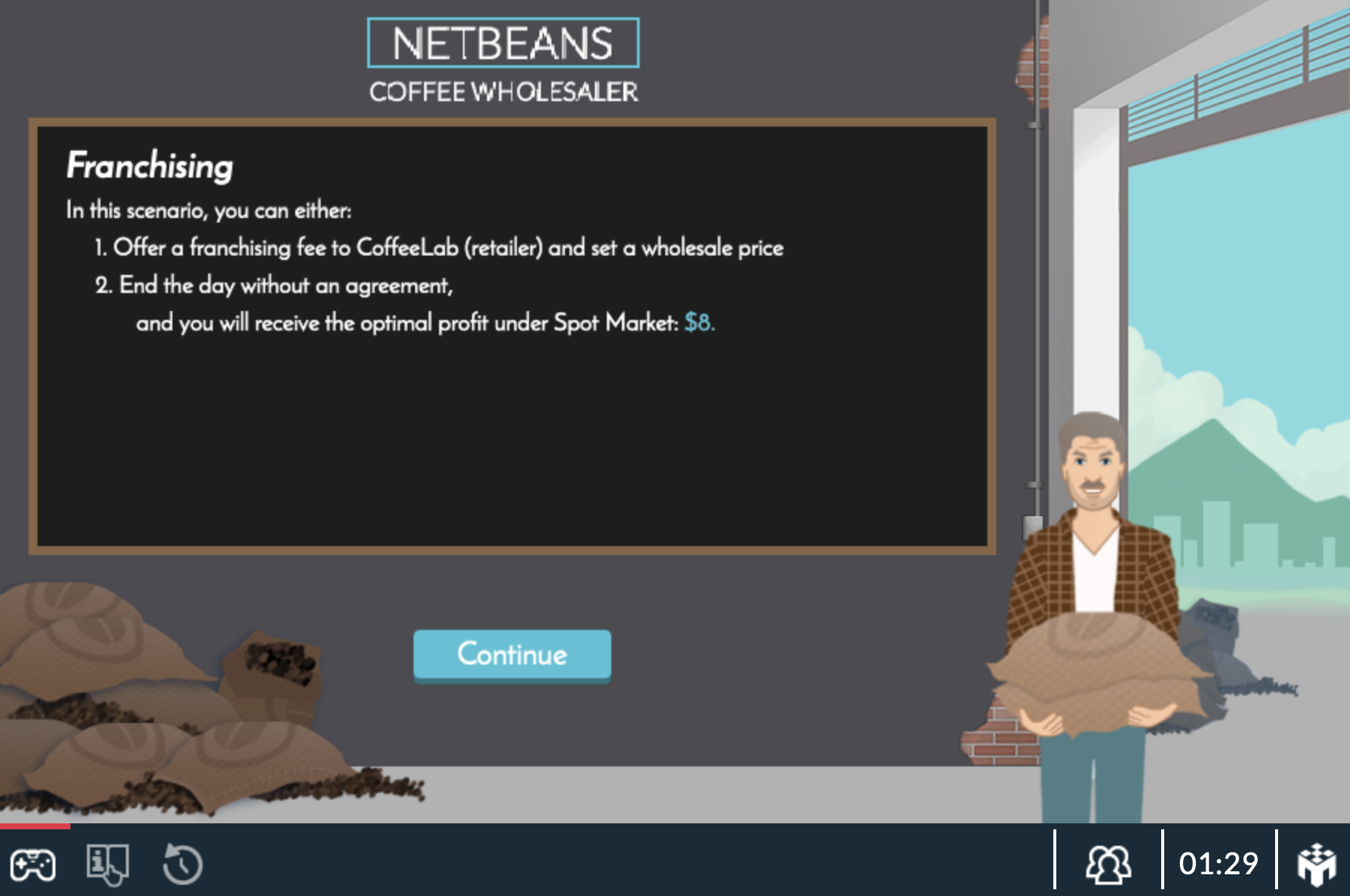

Franchise

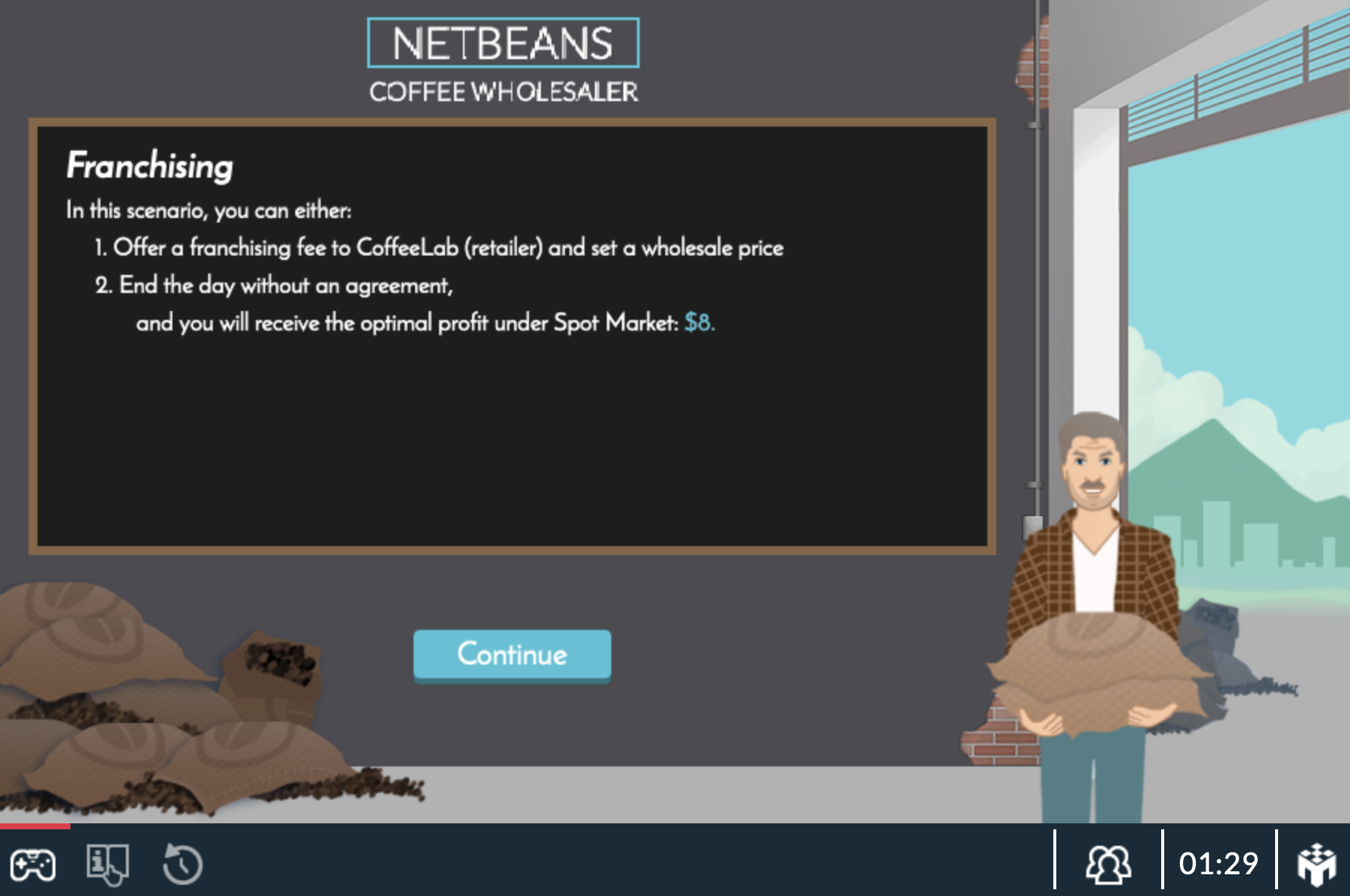

When the Franchise setting is selected, each wholesaler is allowed to offer a two-part deal to the retailer. The wholesaler first sets a one-time franchise fee and then a price for the bags of coffee they will sell to the retailer. The retailer has the option to accept or decline any offer proposed by the wholesaler. If an offer is accepted, the franchisee pays the one-time fee and chooses a quantity of coffee beans to purchase at the wholesaler’s price. If an offer is rejected, the wholesaler can make another offer. However, if no agreement is reached by the end of the round, then the wholesaler and the retailer end up with the optimal Spot Market profit once again! The franchising setting offers a different solution than Merger & Acquisition but shows students that however you fix the double marginalization problem, both the industry and the consumer better off.

Wholesaler and Retailer Franchise Game Screen

Reviewing the Results of Double Marginalization

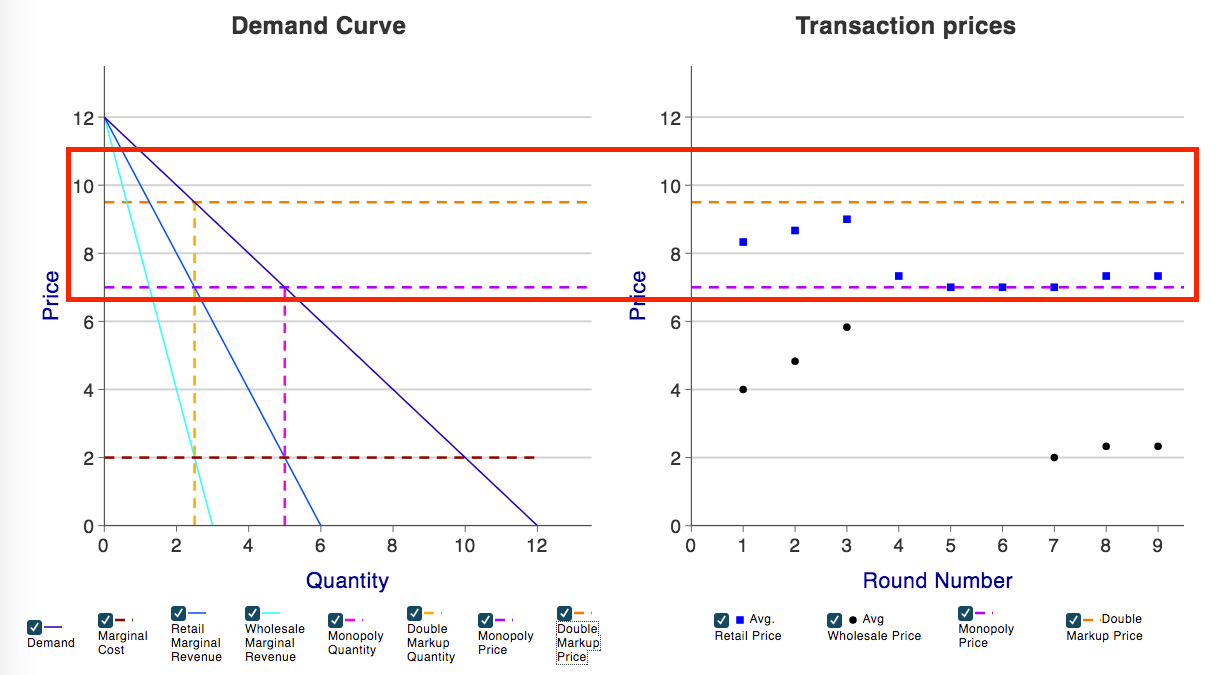

After the game has finished, a great way to help students achieve that “A-Ha!” moment is to share the results from the game. I will use some sample data to demonstrate the benefits of using the results after game play. In the data below, rounds 1-3 were spot markets, rounds 4-6 allowed for mergers & acquisitions, and rounds 7-9 allowed for franchising contracts.

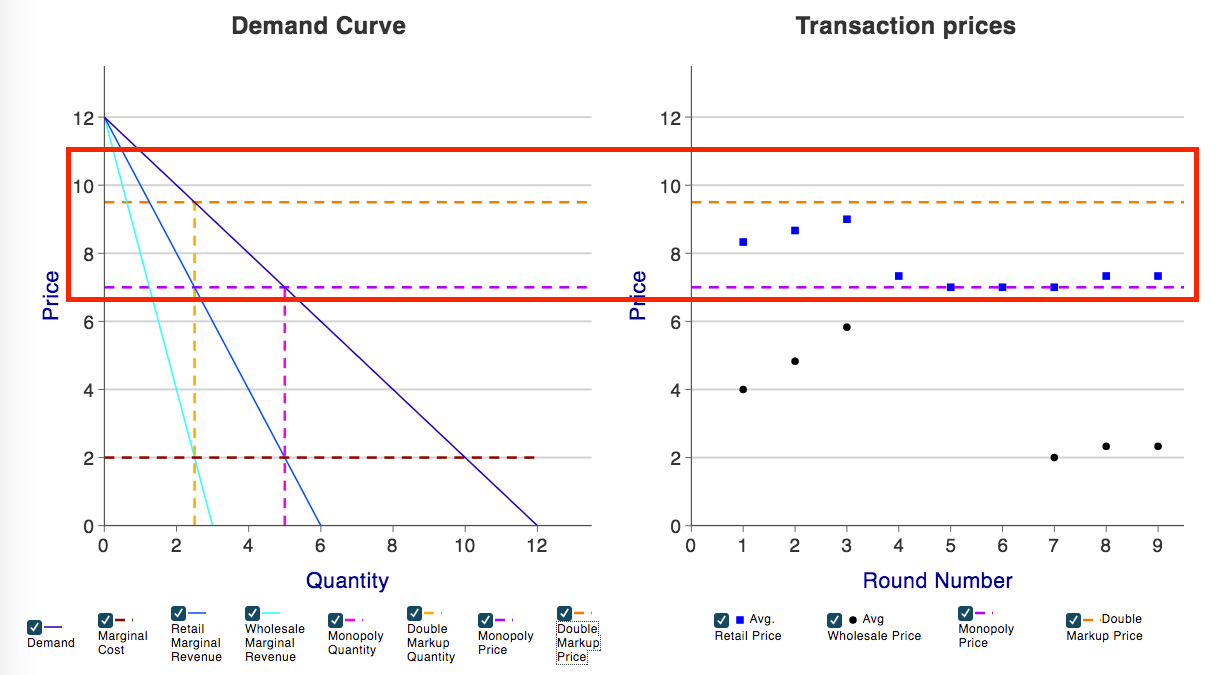

In Figure 1, the dotted orange line indicates the equilibrium retail price under the Spot Market (i.e. the double mark up). The dotted purple line represents the monopoly equilibrium price. In the first three rounds, the student data shows a trend towards the double mark up equilibrium. However, in rounds 4 - 9, when mergers or franchises are allowed, students are able to find the equilibrium monopoly price fairly quickly.

Figure 1. Demand Curve & Transactions

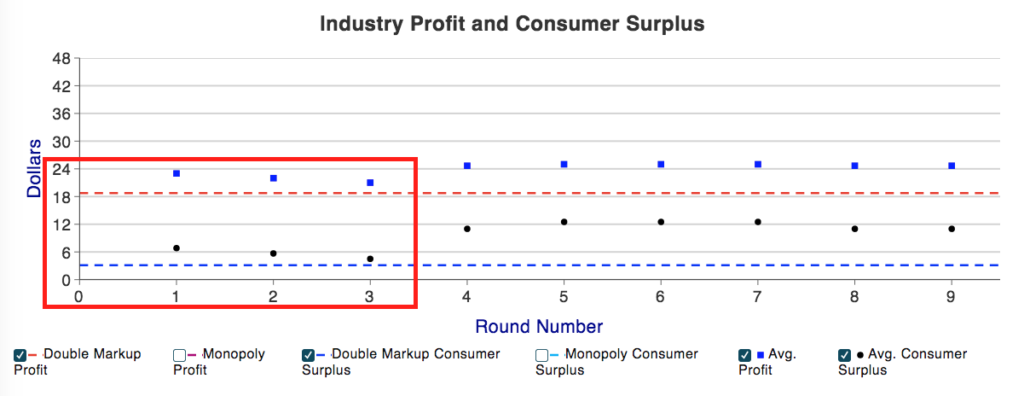

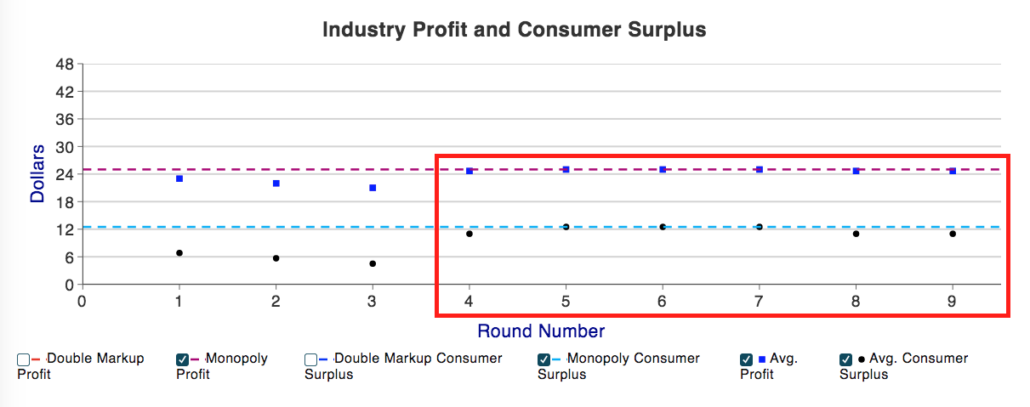

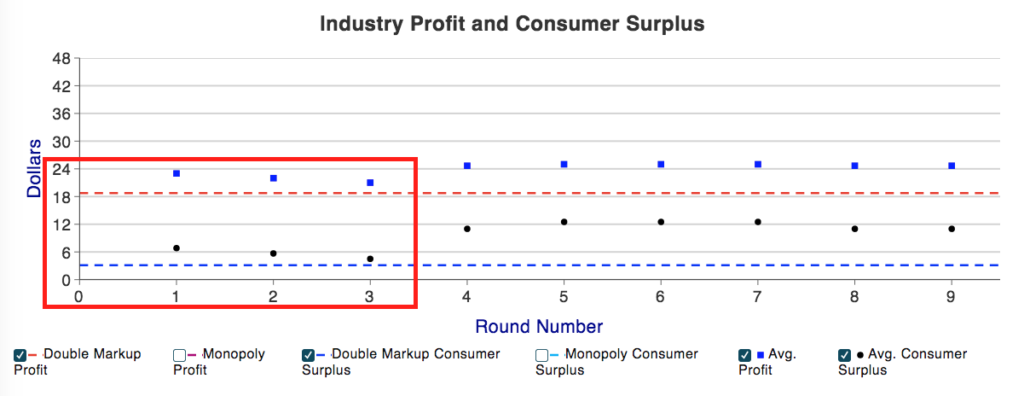

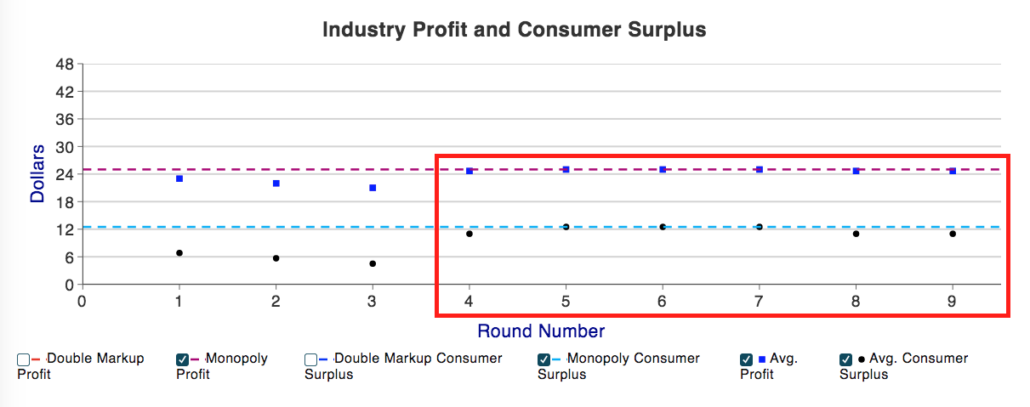

The other graph that appears in the results shows the benchmarks for equilibrium consumer surplus and industry profits (profits from both the wholesaler and retailer), as well as average student behavior across rounds. Figure 2 provides the equilibrium consumer surplus and industry profits in the case of double marginalization and highlights the data from the first three rounds. Figure 3 reveals the same data but when contractual solutions to the double marginalization problem are allowed, highlighting the data from Rounds 4 - 9. In both graphs, there is a trend towards equilibrium.

Figure 2. Industry Profits & Consumer Surplus - Rounds 1-3

Figure 3. Industry Profits & Consumer Surplus - Rounds 4-9

Using the students’ own data to show the benefits of contractually fixing the double marginalization problem allows the theory and application to sink in for students. Not only have they just put themselves into a double marginalization scenario, but they can now view the data that confirms that industry profits AND consumer surplus increase when two monopolies can either merge or establish franchises. The visual of the counterintuitive results, along with the textbook material, will aid in student understanding.

Check out our Double Marginalization game and the rest of our game catalog! Interested in learning more? Schedule a meeting with someone from our team to get started!

Wholesaler (left) and Retailer (right) Spot Market Game Screens

In this game, the double marginalization problem is demonstrated using a coffee supply chain. Students take the role of either a wholesale coffee roaster or a retail café. The wholesalers set a price per bag of coffee, and given that price, the retailers then decide how much coffee to buy. Since the wholesaler and retailer are in the same supply chain but at different vertical levels, the double marginalization problem occurs when both the wholesaler and the retailer mark up their prices, decreasing profits for each entity and reducing consumer surplus in the market. Beyond just demonstrating the double marginalization problem, the game also allows for instructors to play around with a few key treatment variations. The game offers three different integration types:

Double Marginalization configurations on the instructor console

Spot Market

The Spot Market setting puts students into a market where the wholesaler and retailer are operating as independent entities at different points along the same supply chain. The wholesaler proposes a price for a bag of coffee beans and the retailer responds with the quantity of bags they would like to purchase at the proposed price. In this market, profit is the name of the game and each entity is seeking to maximize its own profit. This scenario illustrates that the double mark up that occurs would result in a higher price for the consumer since each entity wants to increase their own profit.

Merger & Acquisition

When the vertical integration setting is selected (Merger & Acquisition), students are allowed to participate in free form bargaining. Both the wholesaler and the retailer can submit offers to acquire the other entity. Each party has the ability to accept or decline any offers. If an offer is accepted, the acquired firm receives a payment equal to the proposal and the merged firm now faces market demand as a monopolist. If an offer is rejected, there is an opportunity to make a counteroffer, but, if no agreement is reached by the time the game is up, both the wholesaler and the retailer end up with the optimal profit in the Spot Market. Selecting this setting shows students one solution to the double marginalization problem.

Wholesaler and Retailer Merger & Acquisition Game Screen

Franchise

When the Franchise setting is selected, each wholesaler is allowed to offer a two-part deal to the retailer. The wholesaler first sets a one-time franchise fee and then a price for the bags of coffee they will sell to the retailer. The retailer has the option to accept or decline any offer proposed by the wholesaler. If an offer is accepted, the franchisee pays the one-time fee and chooses a quantity of coffee beans to purchase at the wholesaler’s price. If an offer is rejected, the wholesaler can make another offer. However, if no agreement is reached by the end of the round, then the wholesaler and the retailer end up with the optimal Spot Market profit once again! The franchising setting offers a different solution than Merger & Acquisition but shows students that however you fix the double marginalization problem, both the industry and the consumer better off.

Wholesaler and Retailer Franchise Game Screen

Reviewing the Results of Double Marginalization

After the game has finished, a great way to help students achieve that “A-Ha!” moment is to share the results from the game. I will use some sample data to demonstrate the benefits of using the results after game play. In the data below, rounds 1-3 were spot markets, rounds 4-6 allowed for mergers & acquisitions, and rounds 7-9 allowed for franchising contracts.

In Figure 1, the dotted orange line indicates the equilibrium retail price under the Spot Market (i.e. the double mark up). The dotted purple line represents the monopoly equilibrium price. In the first three rounds, the student data shows a trend towards the double mark up equilibrium. However, in rounds 4 - 9, when mergers or franchises are allowed, students are able to find the equilibrium monopoly price fairly quickly.

Figure 1. Demand Curve & Transactions

The other graph that appears in the results shows the benchmarks for equilibrium consumer surplus and industry profits (profits from both the wholesaler and retailer), as well as average student behavior across rounds. Figure 2 provides the equilibrium consumer surplus and industry profits in the case of double marginalization and highlights the data from the first three rounds. Figure 3 reveals the same data but when contractual solutions to the double marginalization problem are allowed, highlighting the data from Rounds 4 - 9. In both graphs, there is a trend towards equilibrium.

Figure 2. Industry Profits & Consumer Surplus - Rounds 1-3

Figure 3. Industry Profits & Consumer Surplus - Rounds 4-9

Using the students’ own data to show the benefits of contractually fixing the double marginalization problem allows the theory and application to sink in for students. Not only have they just put themselves into a double marginalization scenario, but they can now view the data that confirms that industry profits AND consumer surplus increase when two monopolies can either merge or establish franchises. The visual of the counterintuitive results, along with the textbook material, will aid in student understanding.

Check out our Double Marginalization game and the rest of our game catalog! Interested in learning more? Schedule a meeting with someone from our team to get started!