In 193 AD, having killed the Emperor Pertinax, the Praetorian Guard in a bold move proceeded to sell off the entire Roman Empire by means of an auction. The winning bid was a promise of 25,000 sesterces per man to the Guard. The winner, Didius Julianus, was duly declared emperor but lasted for only two months before suffering from what is perhaps the earliest and most extreme instance of the “winner’s curse”: He was beheaded.

Ever since the days of the Roman Empire, people invented clever auction designs and formats for the sale of all kinds of goods. Today, the range and value of objects that are sold by auctions has grown to staggering proportions. However, despite their wide-spread use, students often perceive auction theory as an abstract and dry subject to study. This is where MobLab provides a point of connection by immersing students in fun and interactive examples of auction games. Through active participation, students develop an intuitive understanding for different bidding strategies and phenomena like the winner’s curse.

In MobLab’s Common Value Auction game every student acts as a bidder and has the opportunity to do a test drill on a prospective oil field to obtain a private estimate for the value of the field before entering the auction. However, the signal that the test drill provides is noisy and has a known error range. The true value of the oil field is only revealed after the auction. One can expect that the student who obtained the most optimistic estimate will win the auction yet is likely to suffer from a winner’s curse by paying more than the actual value of the field. By running the game for multiple rounds students experience how bid shading may mitigate overestimation. Furthermore, the instructor can illustrate how different price rules and group sizes affect bidding behavior.

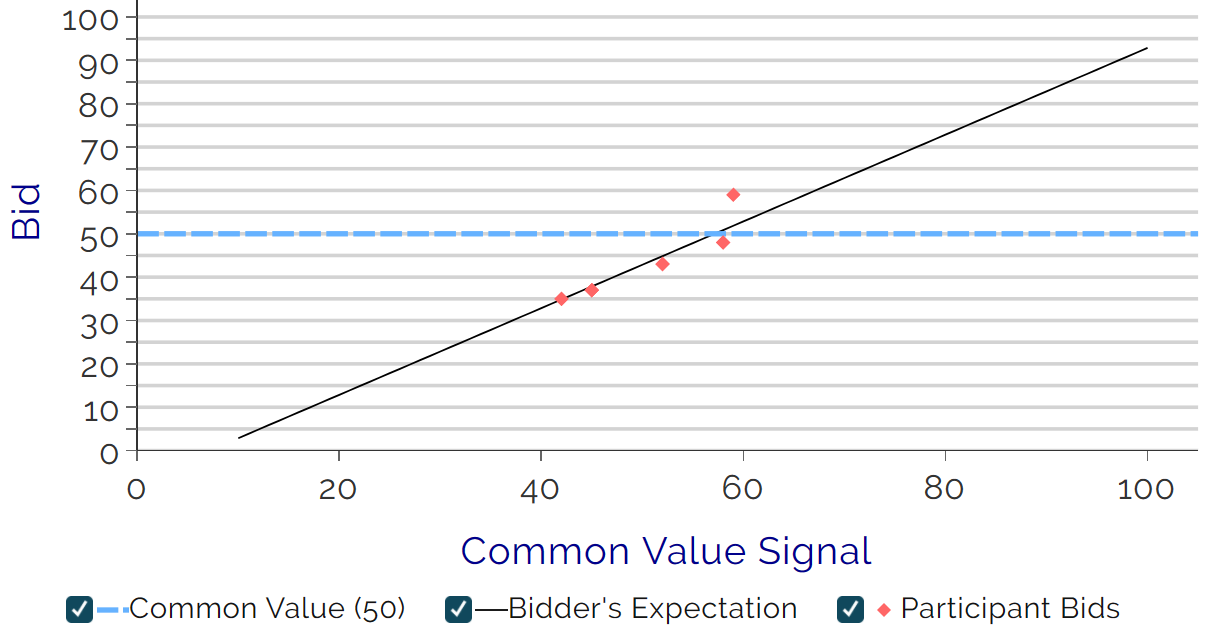

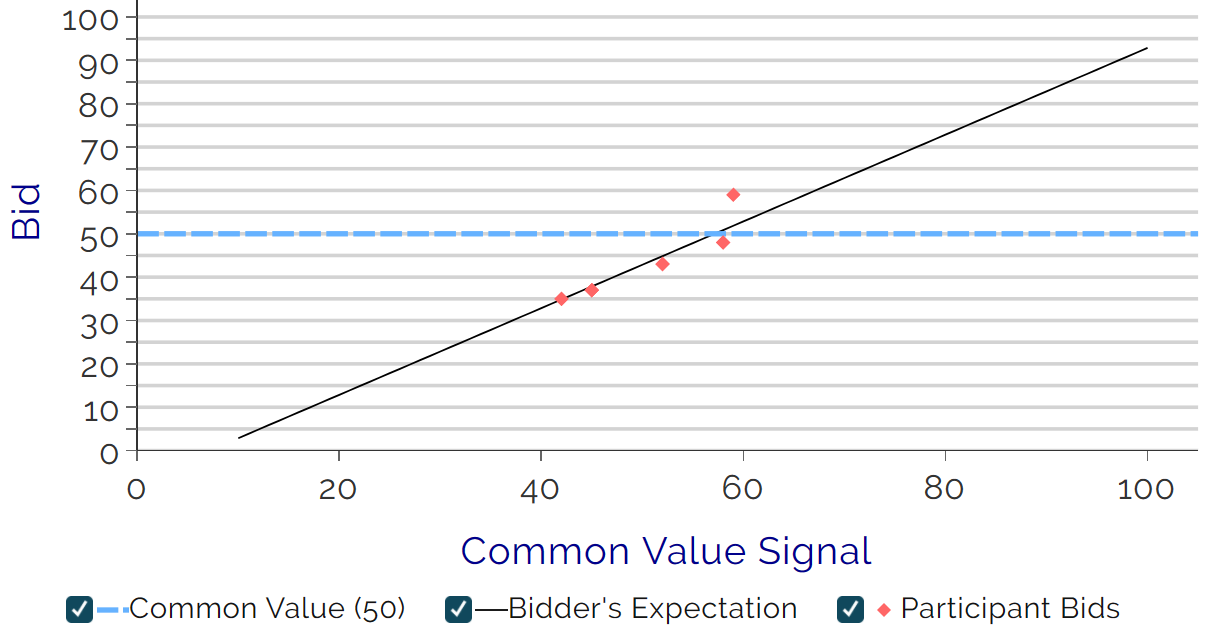

The above results from an experiment with six students evidently show how the student with the highest value estimate (60) also placed this as their bid. However, the actual value of the field turned out to be only 50 resulting in a loss of 10. The phenomenon of the Winner’s Curse and how bidders should optimally behave in such an environment was thoroughly studied by Paul Milgrom and Robert Wilson who were awarded the 2020 Nobel Memorial Prize in Economic Sciences.

Ever since the days of the Roman Empire, people invented clever auction designs and formats for the sale of all kinds of goods. Today, the range and value of objects that are sold by auctions has grown to staggering proportions. However, despite their wide-spread use, students often perceive auction theory as an abstract and dry subject to study. This is where MobLab provides a point of connection by immersing students in fun and interactive examples of auction games. Through active participation, students develop an intuitive understanding for different bidding strategies and phenomena like the winner’s curse.

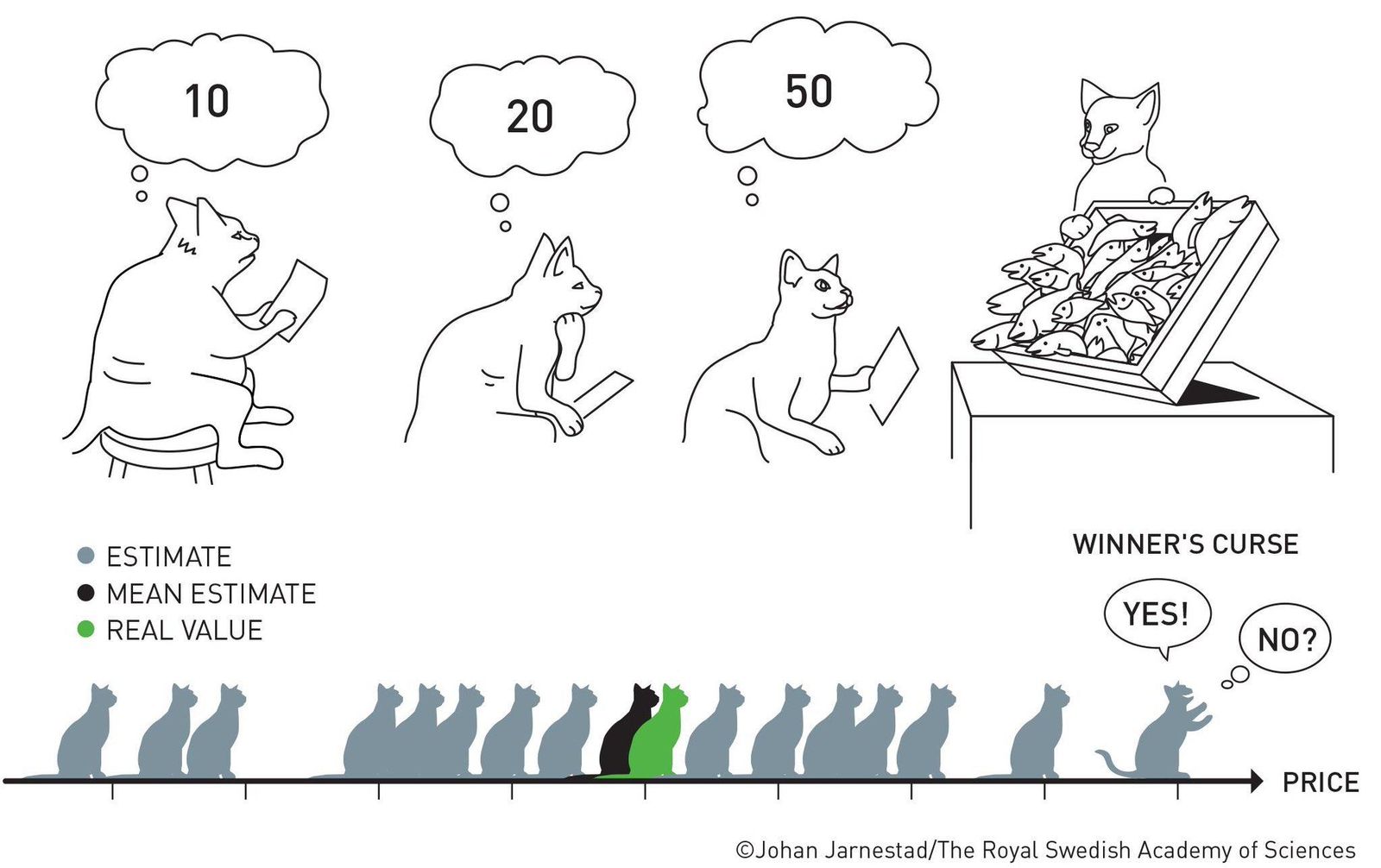

What is this stealthy winner's curse all about?

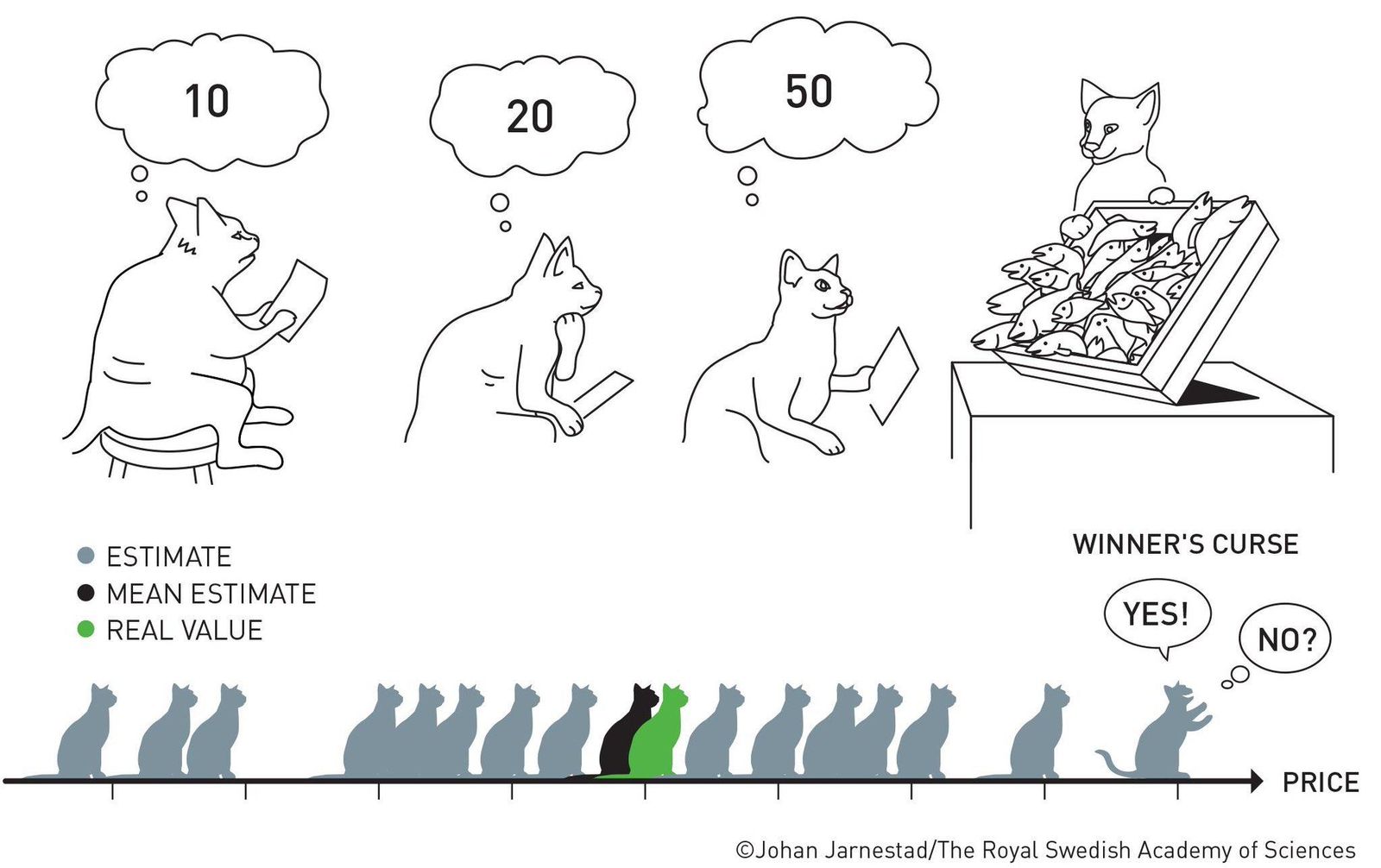

Auctions are used precisely because the seller is unsure about the value that bidders attach to the object she is trying to sell. On the other side, it is often assumed that every bidder knows exactly how much they personally value the object, e.g. a piece of art, and what they are willing to pay for it. Yet, in many situations the exact value of the object is neither known to the seller nor to the bidder. During the auction, every bidder may have an individual estimate of the value based on private research or an expert’s opinion. This is often the case when a bidder sees the object as an investment and assigns a value on the basis of how much the object will yield in the future - for example the rights to an oil field. The actual value of those rights, is determined by the invisible quantity of oil underground and the price per barrel on the market. Therefore, the value, though unknown at the time of bidding, is the same for all bidders, resulting in a so-called common value auction.

In MobLab’s Common Value Auction game every student acts as a bidder and has the opportunity to do a test drill on a prospective oil field to obtain a private estimate for the value of the field before entering the auction. However, the signal that the test drill provides is noisy and has a known error range. The true value of the oil field is only revealed after the auction. One can expect that the student who obtained the most optimistic estimate will win the auction yet is likely to suffer from a winner’s curse by paying more than the actual value of the field. By running the game for multiple rounds students experience how bid shading may mitigate overestimation. Furthermore, the instructor can illustrate how different price rules and group sizes affect bidding behavior.

The above results from an experiment with six students evidently show how the student with the highest value estimate (60) also placed this as their bid. However, the actual value of the field turned out to be only 50 resulting in a loss of 10. The phenomenon of the Winner’s Curse and how bidders should optimally behave in such an environment was thoroughly studied by Paul Milgrom and Robert Wilson who were awarded the 2020 Nobel Memorial Prize in Economic Sciences.

More Auctions

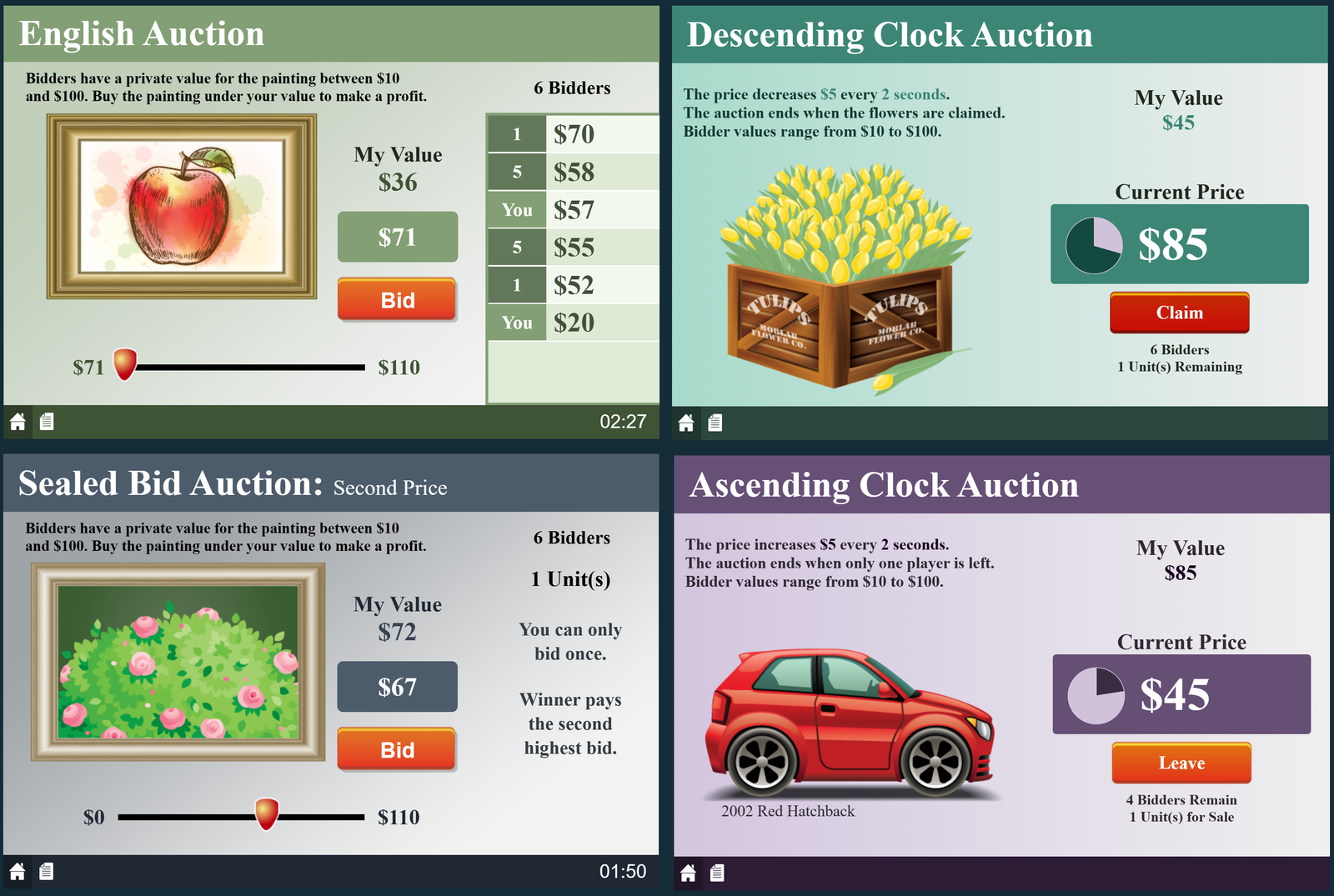

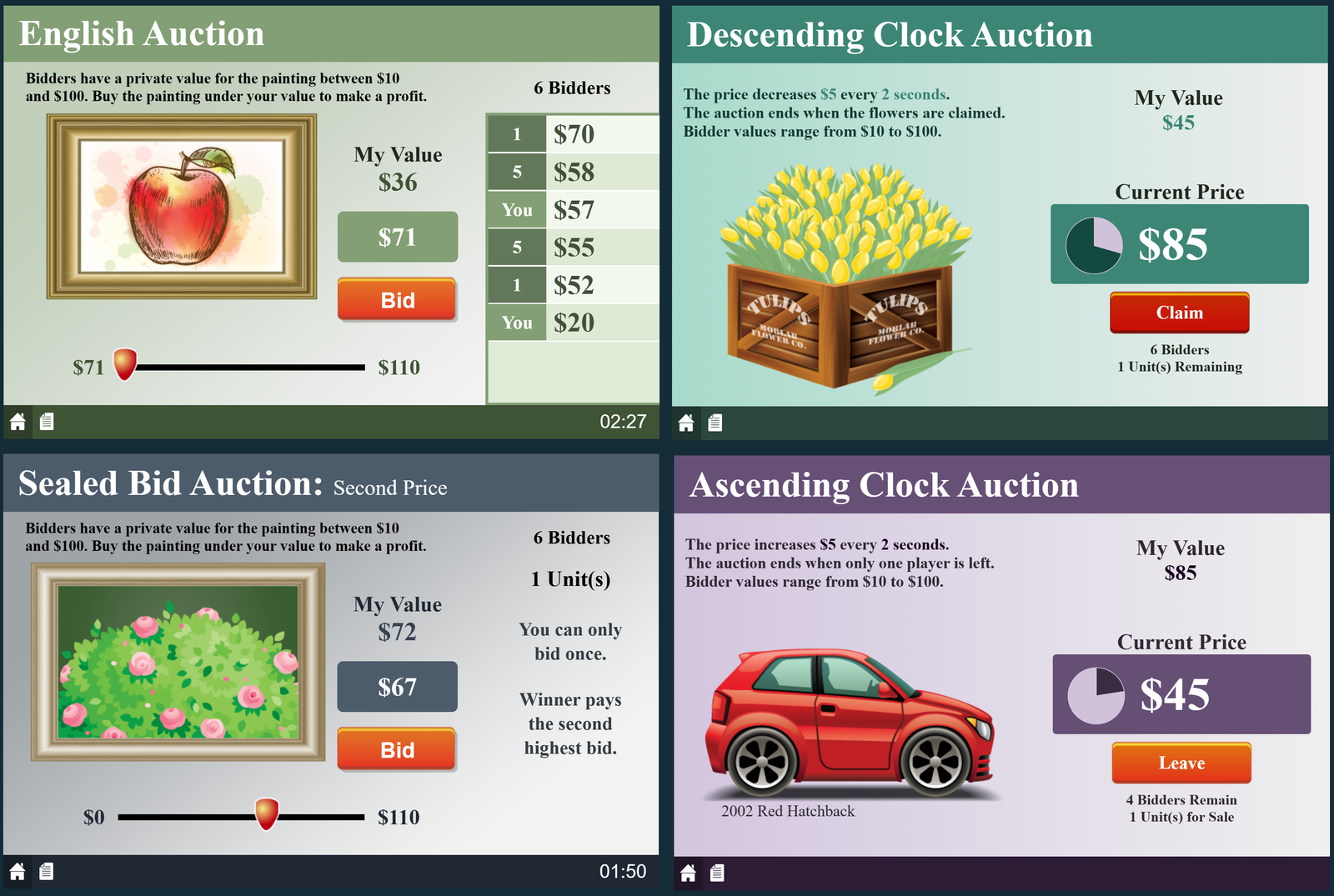

Our economics games library contains further popular auction formats like English, Descending Clock-Auctions, as well as First price and Second Price Sealed Bid auctions. Instant results with detailed summaries and graphs allow for comprehensive comparison between different auction formats as well as between theoretic predictions and human bidding behavior.